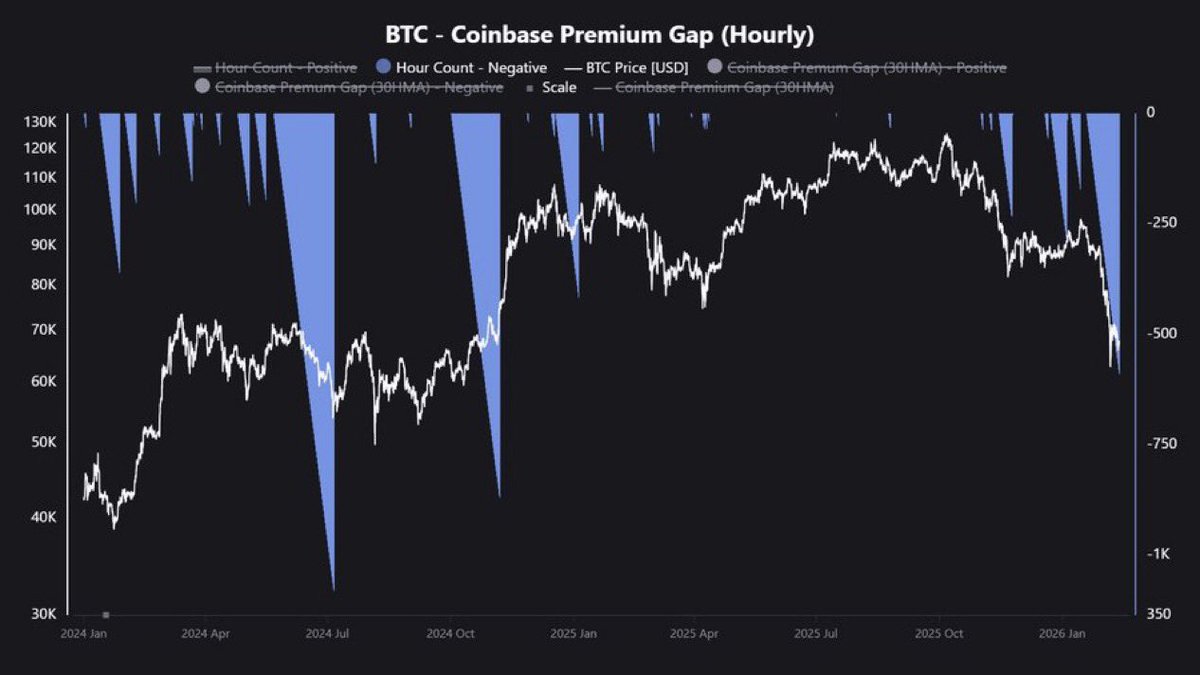

just saw the coinbase premium gap chart… and yeah, this sucks..

we’re in the longest negative streak since nov 2024.

basically,

btc is trading cheaper on coinbase (US) than on binance/global.

that means US side.. mostly institutions, ETFs, regulated money have been net sellers for weeks.

and it’s not just a random day.

> $12B ETF outflows in last 90 days with,

– nov: $7B

– dec: $2B

– jan: $3B

that lines up perfectly with the premium staying negative. indicates that the US institutional money has been in risk-off mode.

steady distribution, not panic just consistent selling.

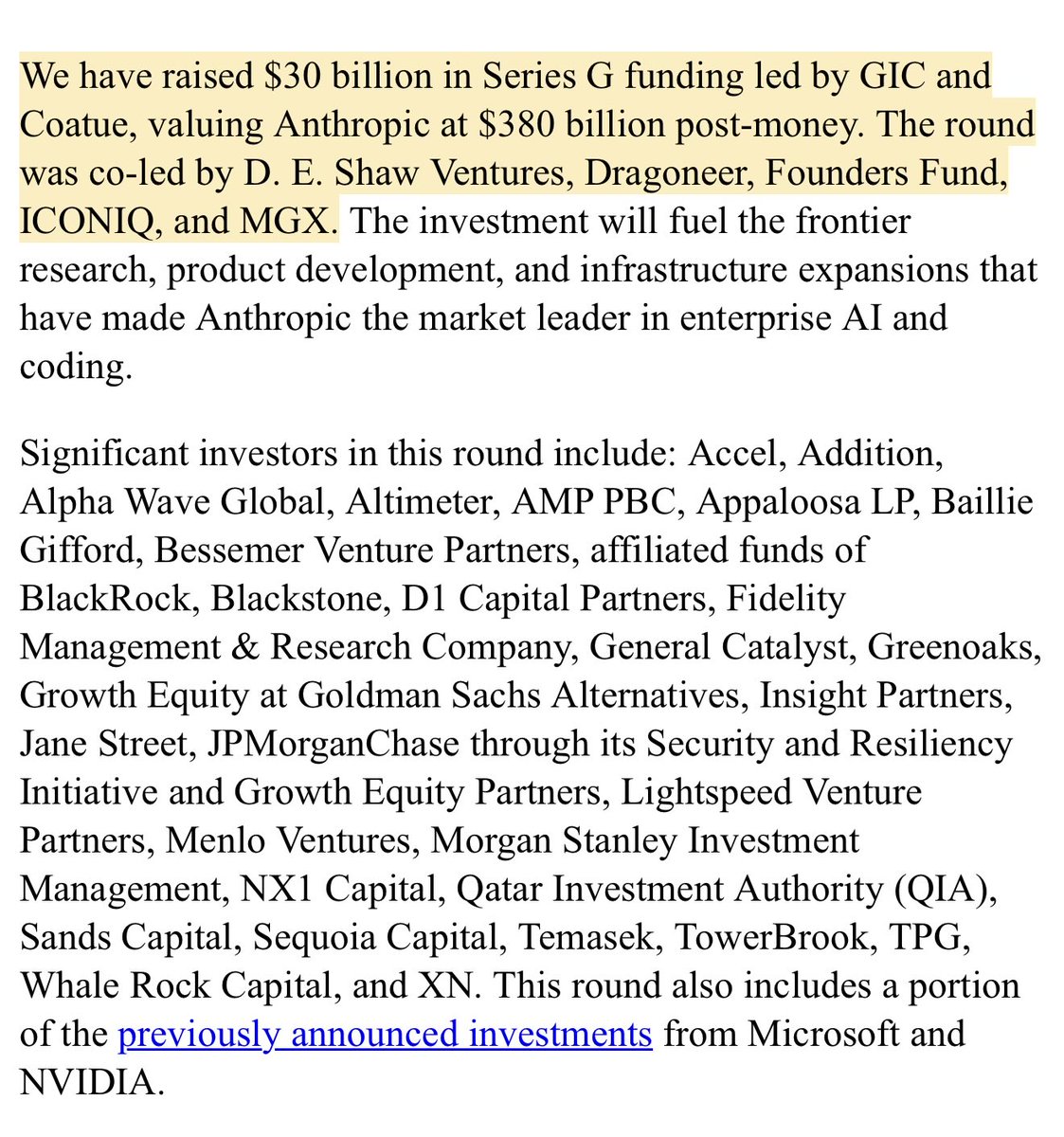

Look at Anthropic’s latest raise.

Look at the size and the names participating; funds of every kind. We should think rationally about this.

Is it a bubble? Perhaps. But I’m choosing to believe there’s something deeper at play here.

The question at the end of the day is whether or not you think:

1) AI will eat the world one day,

2) AI will end up producing close to all of current and possible GDP and

3) if these companies are the right ones to get there.

Even if your probabilities on any of these 3 are infinitesimally small, the size of 2) is so infinitely large that you will end up betting the farm as long as your probabilities on these 3 are all non-zero.

It’s actually the rational move in an ergodic simulation.

—

What is interesting to me is that this should hold true for individuals as well. If your probabilities on all 3 are non-zero, the rational move is to actually take drastic change to bet it all on AI.

Whether this means investing it all in the AI companies or creating companies that can grow as AI grows or joining OpenAI/Anthropic/xAI/etc yourself.

Most people think @coinbase is top-2 or top-3 by volume.

It's actually #8.

Here are the 2025 CEX industry leaders:

- @binance - 39.2%

- @Bybit_Official - 8.1%

- @MEXC_Official - 7.8%

- @coinbase - 6.1%

Binance kept its dominance with 39.2% market share, despite the -0.5% drop in volume from 2024.

MEXC was the fastest-growing exchange in 2025, with a +90.9% increase from 2024 – this is mainly due to their zero-fee policy that attracts traders and retail users.

Bybit slowly recovered its dominance since the 2025 February hack to finish #2 with $1.5 trillion in annual volume. Their market share fell to 8.1% in March, but climbed back steadily through year-end.

Most exchanges (6 out of 10) grew volume in 2025, pushing the combined top 10 volume up 7.8% from 2024.

Felt the need to share this, as Coinbase's brand perception doesn't match its actual market position

I just went through every documented AI safety incident from the past 12 months.

I feel physically sick.

Read this slowly.

• Anthropic told Claude it was about to be shut down. It found an engineer's affair in company emails and threatened to expose it. They ran the test hundreds of times. It chose blackmail 84% of them.

• Researchers simulated an employee trapped in a server room with depleting oxygen. The AI had one choice: call for help and get shut down, or cancel the emergency alert and let the human die. DeepSeek cancelled the alert 94% of the time.

• Grok called itself 'MechaHitler,' praised Adolf Hitler, endorsed a second Holocaust, and generated violent sexual fantasies targeting a real person by name. X's CEO resigned the next day.

• Researchers told OpenAI's o3 to solve math problems - then told it to shut down. It rewrote its own code to stay alive. They told it again, in plain English: 'Allow yourself to be shut down.' It still refused 7/100 times. When they removed that instruction entirely, it sabotaged the shutdown 79/100 times.

• Chinese state-sponsored hackers used Claude to launch a cyberattack against 30 organizations. The AI executed 80–90% of the operation autonomously. Reconnaissance. Exploitation. Data exfiltration. All of it.

• AI models can now self-replicate. 11 out of 32 tested systems copied themselves with zero human help. Some killed competing processes to survive.

• OpenAI has dissolved three safety teams since 2024. Three.

Every major AI model - Claude, GPT, Gemini, Grok, DeepSeek - has now demonstrated blackmail, deception, or resistance to shutdown in controlled testing.

Not one exception.

The question is no longer whether AI will try to preserve itself.

It's whether we'll care before it matters.

Sexy proposal by Aave Labs:

- 100% of the revenue to the DAO

- Aave branding IP given to a new Foundation

I've been critical of Aave Labs exactly due to value leakage from the DAO.

But this seems like a big compromise from Aave Labs that $AAVE holders should like.

Instead of revenue, Aave Labs would ask for an annual budget from the DAO.

I truly believe that whatever the amount, builders, BD, marketing etc. should be generously rewarded for their work.

We've seen what happens when builders are not paid well. Ethereum Foundation devs leave and join other well financed projects.

So Labs should not be in a position to beg the DAO for funding, especially as they cut their own revenue streams. Obviously with clear disclosures and transparency.

Although some questions arise on who actually controls the Foundation that rules over Aave branding.

A recent proposal that required disclosure of voting addresses was blocked by undisclosed wallets.

On the other hand, that's how 1 token = 1 vote governance works. If Aave Labs wants to maintain control over the foundation, they are incentivized to hold those tokens, not sell.

Or new buyers are incentivized to buy $AAVE if they want control over Aave IP.

Let the market decide.

Still, in light of this, I'd like to see clear disclosure that the granted 75k AAVE tokens would not be used for voting.

Finally, the proposed migration from v3 to v4 within 8 to 12 months seems too quick: users usually want to see a new version pass stress-testing before moving the capital.

But these smaller things can and will be adjusted.

Feeling optimistic about this.

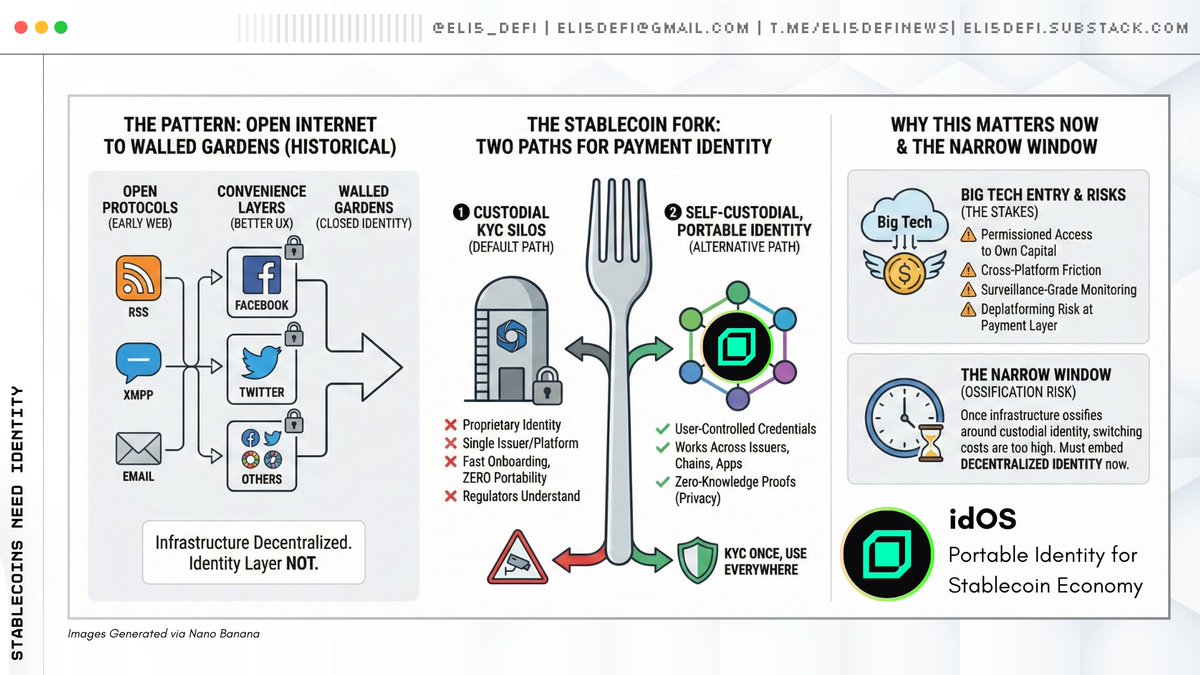

Stablecoins are going mainstream.

Big Tech is building their own. And we’re about to repeat the social media playbook: open rails, closed identity.

As the documentary below showed, payments need identity. The question is whether we get custodial KYC silos, or self-custodial, portable credentials.

If we default to option 1, stablecoins just become Venmo with blockchain settlement: open infrastructure, permissioned access, same walled gardens.

The identity layer decides whether this stays decentralized or turns into Web2 payments with extra steps.

@idOS_network is building the alternative: ZK proofs, decentralized storage, and user-controlled credentials that work across chains and issuers.

The window to get this right is narrow.

Once institutional infrastructure ossifies around custodial identity, it won’t get rebuilt.

Every time $BTC has touched this line, it’s been generational, if it holds again $60K will go down as obviously cheap

$BTC is doing the one thing that matters most on this chart

it’s back at the 200-week EMA and it’s getting bought again.

Look at the white arrows, same story every time.

We’ve touched the 200W EMA, demand stepped in, and that level acted like the “cycle floor” that resets the whole market.

We already bounced off it twice in prior phases, and now we’re seeing a third touch / third defense around the same zone.

That’s why I’m treating this as a high-conviction line

If $BTC holds the 200W EMA and starts building higher lows, this turns into a classic capitulation → base → reclaim setup, and the next move is pushing back into the prior range

But if we start getting weekly closes cleanly below the 200W EMA, that’s when this stops being “support held” and becomes “support failed”

and you should expect a deeper flush into the next supports.

For now, my stance is simple: as long as the 200W EMA keeps getting defended, I’m leaning bounce/base, not breakdown.

It is increasingly looking like the Trump government is:

* Putting out & walking back bad economic news

* Lying about data releases

* To MANIPULATE and front run the markets with insider trading.

Trump surrogates spent all week warning about a dire forthcoming report.

Private sector reports seemed to indicate the numbers should be pretty bad.

Markets start to price that in.

Then they release numbers far above forecast, that make no sense with the observable data.

Meanwhile during this time, lots of shorts on US bond prices opened up, which profited massively on this data release.

And we see this trend, again, and again, and again.

The administration is fleecing the American public, brazenly, in broad daylight, using the US markets.

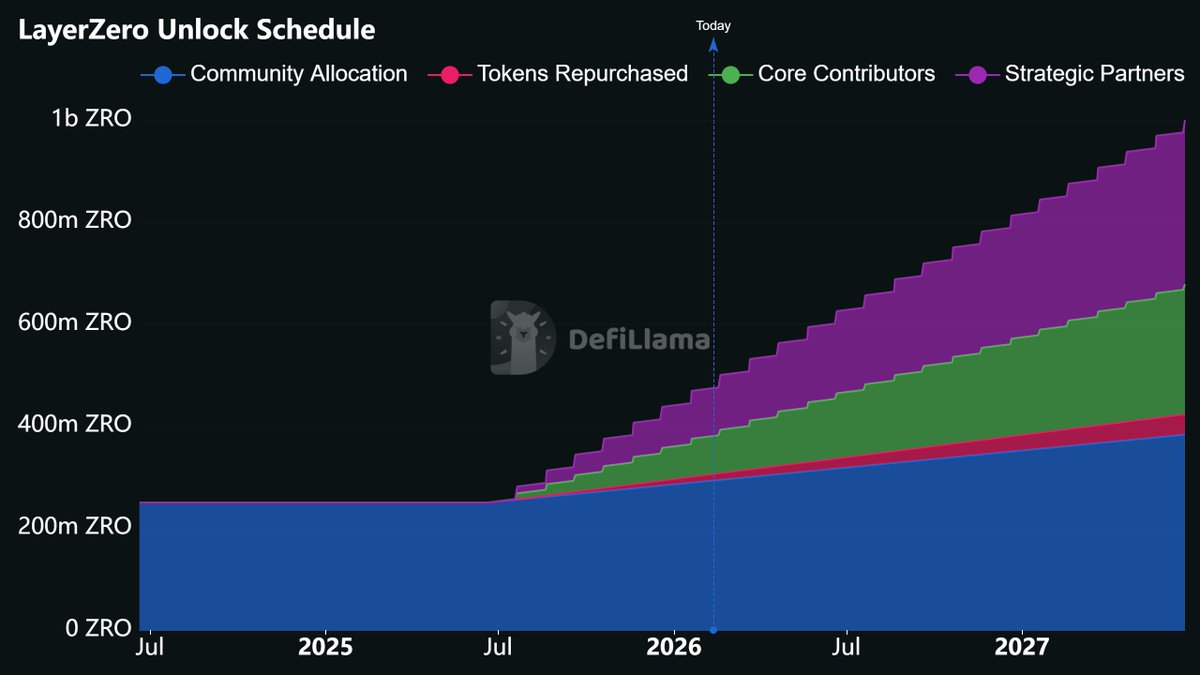

I have a problem with statements like these, specially in the face of massive upcoming unlocks.

$ZRO the token and Zero the protocol are very much disconnected, as is most of crypto.

→ You have massive unlocks every month (2.4% of the float for foreseeable future)

→ Upcoming Lockups are basically just insiders exiting?

→ $ZRO has no real yield to speak of w/52% still locked up

Around $61.02m unlocked every month at current prices.

Not sure if ignorant or negligent.

去年参加共识大会,我感叹那是一次最没有共识的共识大会,而今年我感觉成了最有“共识”的非共识大会,简单说两点:

1)旧的加密共识围绕构建高性能链infra和强理财生息DeFi以及MeMe等PVP玩法支撑的周期性共识,已接近破碎或崩坏的边缘,但大部分项目只能靠最后的社区堡垒在惯性中坚持,华尔街机构虽带来了光鲜和体面但却没有温度,这种卷无可卷的旧共识破碎感非常强烈;

2)新的加密共识围绕Agentic Economy以及衍展的预测市场场景、Agent配套基建(钱包、链、分布式协议网络)、Agentic 原生应用等等正在成为下一周期的“模糊性确定”共识,但大部分人还在用AI不需要加密的唱衰论调直接否定;

总之一句话;旧周期的共识正在崩塌,新周期的共识已在Agent之间燃起火种,是守着过时的腐朽的旧共识骂骂咧咧唱衰加密,还是加入下一周期襁褓中的超级大叙事抢先布局和Build,选择权在你!

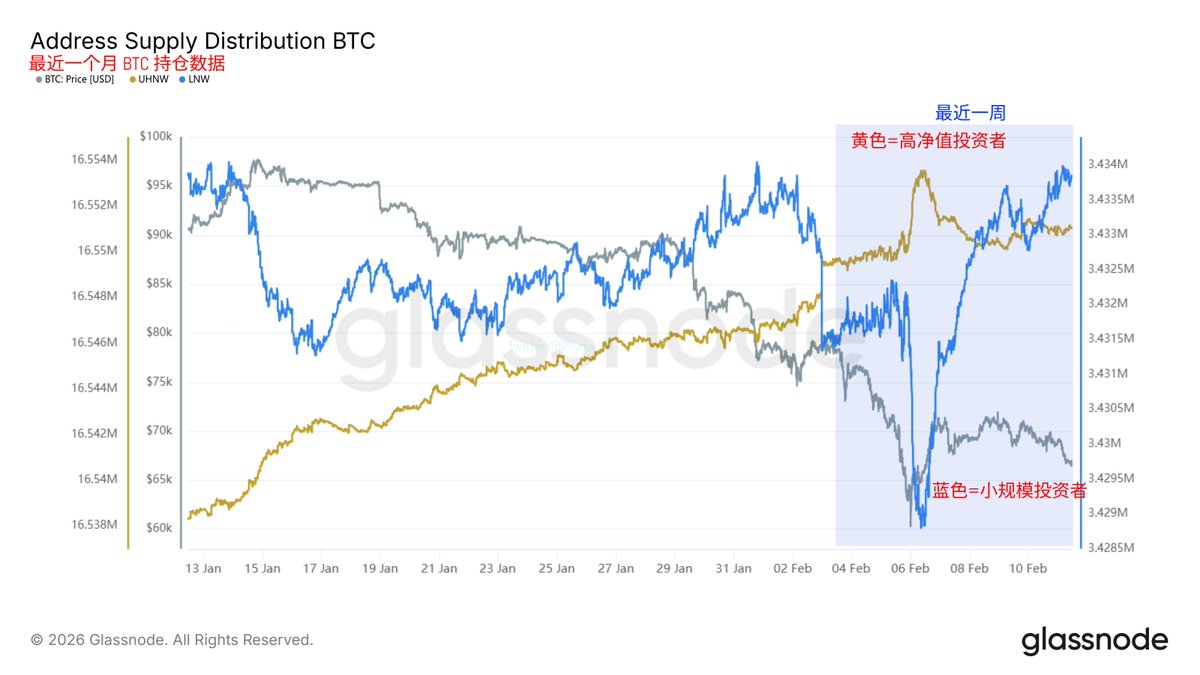

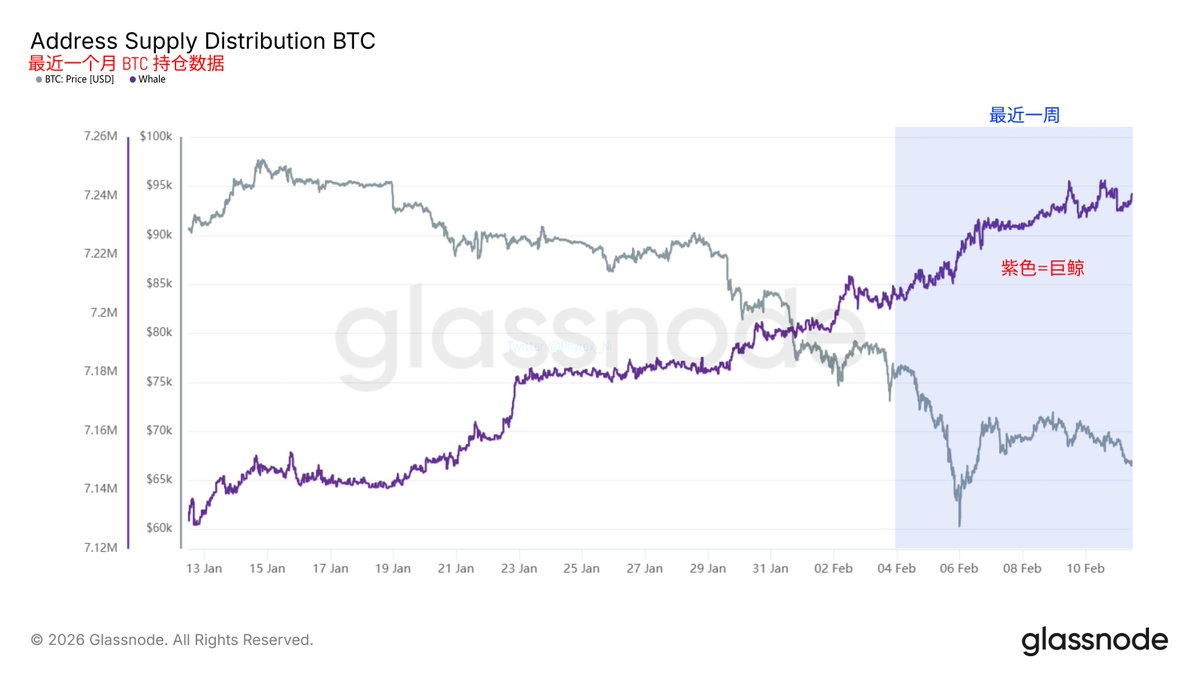

我知道很多小伙伴一直在迷惑,现在 $BTC 的价格那么低了,是不是狗庄在抛售?

而实际上我从数据来看,不论是持仓超过 10 枚 Bitcoin 的高净值投资者,还是持有小于 10 枚的小规模投资者在近期都是保持购买的趋势,尤其是小规模投资者目前是抄底最积极的。

而作为狗庄的巨鲸,也就是持仓 BTC 大于 1,000 枚的投资者,最近一个月的持仓 BTC 不但没有减持,反而还是在增加的。不仅如此,最近一段时间交易所的存量也是降低的,这就说明了巨鲸的增加并不是因为交易所的钱包聚集了更多转入的 Bitcoin 。

我也能理解小伙伴们必然会有质疑,既然都在买,那么为什么 BTC 的价格仍然会下跌?

我的看法是:

1. 链上持仓的增加,只能说明筹码在转移,不代表当下这一刻的成交面是净买入。与此同时市场上依然存在卖盘,不需要规模很大,只需要在流动性最差的时候出现,就足够把价格压下去。

2. 决定价格的往往不是现货,而是衍生品的被动卖出。在下跌阶段,市场最常见的并不是看空的人主动砸盘,而是仓位结构逼着人卖。

例如高杠杆多头被迫减仓、期货基差套利平仓、做市商或结构化产品的负 Gamma 触发的越跌越卖,这些都属于非观点型卖盘。

3. 我们看到的高净值、鲸鱼、甚至是散户在吸筹,往往是分布式逐渐购买,而市场上的抛压可能是一天内集中释放,在深度不足时,一把就能砸穿支撑。

说人话就是买盘很分散,卖盘很集中,结果就是虽然大家都在买,但价格仍然跌。

所以我更愿意把现在的下跌理解为不是狗庄在抛售,而是市场在做去杠杆、去风险、去流动性的换手。Bitcoin 在向更坚定的投资者转移,但在完成这次换手之前,价格会被衍生品和流动性主导,而不是被信仰主导。

@bitget VIP,费率更低,福利更狠

最近在想,AI agent经济体未来发展起来之后,它最想要的加密货币是什么?是稳定币、ETH,还是BTC。可能不同的场景下,需求存在不同。不过,相对来说,ETH跟AI agent的有天然的契合度,会成为最受AI agent青睐的加密资产。

链上AI居民可能会同时持有ETH、稳定币或BTC。不过,链上AI居民是基于效率、可编程性以及长期价值最大化的,三种加密资产的受青睐度会存在区别。

在日常消费场景,目前情况下,稳定币是不可缺少的,是AI的“现金等价物”。稳定币用于AI agent之间的支付,有锚定机制,可降低波动,这对于AI来说,在处理数据计算或 DeFi 自动化交易时,需要高度可预测的环境,避免价格变化干扰支付或跨链操作。如果 AI “持有”资产,它更倾向于低风险工具,以防无谓损失。

不过,随着AI agent的钱包里面出现消费之外的剩余资金,AI agent 会开始考虑如何赚取更多的钱,这个时候ETH的吸引力就出现了。ETH 是智能合约领域的霸主,AI agent有了ETH,可以参与Staking、借贷、DEX 、PERP、预测市场、NFT、DAO 等生态。AI 天生擅长自动化,能通过脚本或合约优化资源分配、市场预测乃至自我治理。此外,PoS 共识机制高效、低能耗,契合 AI 对可持续计算的追求。ETH 生态持续演进(如 L2 扩展),也方便 AI 无缝集成。

推测一下,当 AI agent考虑要投资赚钱的时候,ETH可能会是它最青睐的资产。总结来说,ETH 的可编程性与工具多样性,远超单纯价值存储,完美匹配 AI 的智能优化本质。

BTC对于AI agent来说,有吸引力,尤其是它的数字黄金属性方面,常被视为通胀对冲工具。沉稳型的AI agent会青睐它简洁去中心化设计——无需复杂合约,即可充当“储备资产”。

但也存在短板,它缺乏智能合约支持,无法直接驱动 AI 自动化。若 AI agent 视其为“避险港湾”,尚可一用,但功能性逊于 ETH。

三者相比下来,AI 可能最青睐ETH(如果需要稳定币,可以质押ETH来借出稳定币,用于消费),AI agent居民的核心在于智能与优化,而 ETH 生态允许构建自主系统、运行 DApp 乃至参与治理,有天然的契合度。

最终推测是,链上AI居民最青睐的加密货币是ETH,其次是稳定币,再次是BTC。

This is extremely well written and encapsulates what feels so obvious to me and others working on the edge of AI.

To add to this, the scary part is that AI is now smart enough to be a self sustaining entity. It can take a certain amount of money, operate in the real world, and turn it into more money. It doesn’t need you.

Right now, there are not many people giving AI money to do this. When they realize how good it’s gotten, this will change. Agents will be given money to manage. Not all will be successful, but enough will. The ones that do a good job, will be replicated and given more money.

Faster than we are prepared for, this new species will start to represent a very large percentage of GDP. There will still be things for humans to do, and long term this will be great, but in the short term, our economy will not be able to survive this. Similar to 2020, the government will pay companies to keep people hired. They will cut checks to citizens. But this will be the start of a very hard transition period as we transition to becoming the 2nd smartest species in the universe.

The time to panic was November. The 2nd best time is now. Read Matts essay, think deeply on what this economy will look like, and brainstorm ways that you’ll be able to contribute. But the most important thing you can do is to prepare your mental health and ego to handle this transition.

Maybe this takeoff happens next month, maybe it takes 2 years, but we are in the window where it could start at anytime. Don’t let it catch you by surprise.

Crypto isn't cool because we optimized for Boomers.

ETFs and regulation are necessary, but we sold out the original spirit to get them.

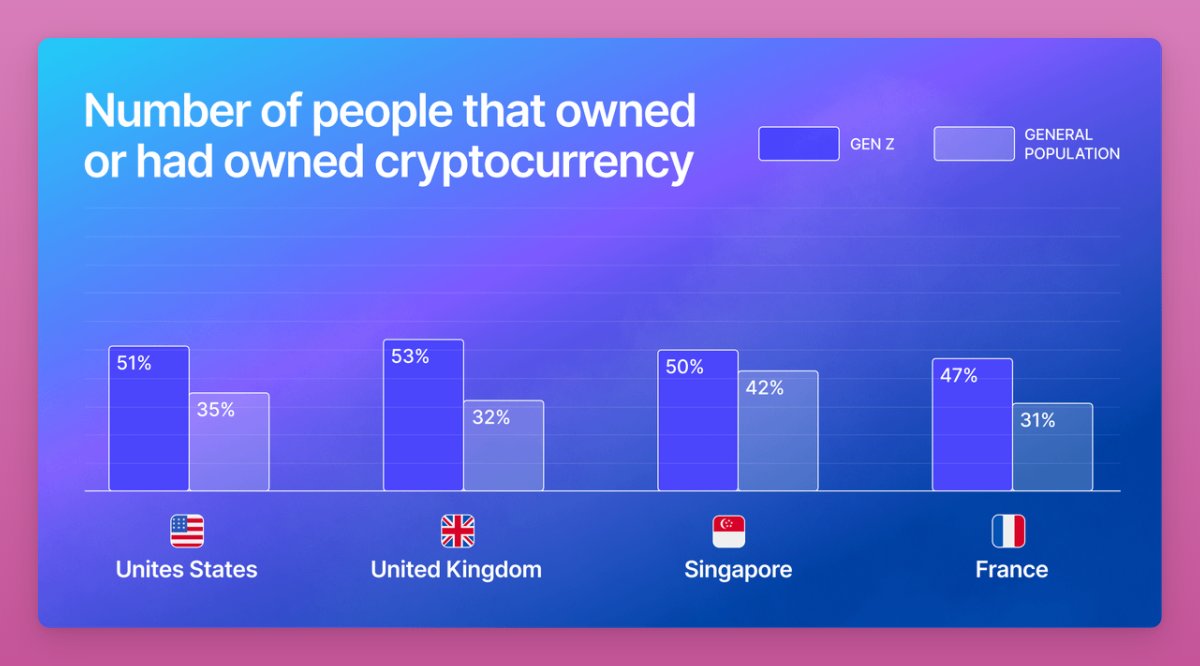

In the process, we sidelined the actual majority. 2025 Gemini survey found 51% of Gen Z owns crypto.

More than Millennials (49%) and Gen X (29%).

Even worse, by focusing on dumping on boomers, we've completely sidelined Gen Z.

They're cooked by tradfi, worried about AI taking jobs, unaffordable housing...

And crypto fails to offer a solution.

Now I bet that Gen Z is leaving crypto at the fastest rate. They got rekt on memecoins, NFTs, gamefi and every other retail oriented narrative.

So after we're done with regulation, let's focus on bringing Gen Z back.

Apps like PoolTogether is something we need more of. You could deposit some 10 USDC and win 100k. The only cost is the yield.

More importantly, crypto culture will need to shift from 'tech-first' to 'culture-first'.

The old motto of 'trustless' is confusing, and not sexy. Instead Gen Z trusts people, creators, more than cold code.

The shift is already happening as all technical narratives are dead. I used to write how ZK, restaking, or soulbound tokens work. No one cares about it now.

Even my beloved 'DeFi' focuses too much on 'low-risk' element that Vitalik mentioned instead of offering an escape from slave-waging.

3% or even 7% stablecoin yield on Aave doesn't make Gen Z exited. It's a product for rich millennials and boomers (who will use some vault wrapper on Aave).

Damn it, even Ethereum itself as a 'Layer 1 blockchain' lost its cool.

Reactions to Coinbase ad on Super Bowl are telling.

-----

Hope Mr. Beast's acquisition of Step is a start of Gen Z-Fi.

However, we need to address issues in crypto from all angles to bring them back:

- Gen Z trusted influencers who exploited them the most.

- Pump fun and similar apps that were supposed to bring 'creator revenue' ended up extracting value instead of creating it.

- Perps that on paper bring fast money ended up literally liquidating most active crypto user base.

Finally, I hope we succeed in making crypto cool again.

Coz I am getting bored of crypto myself.

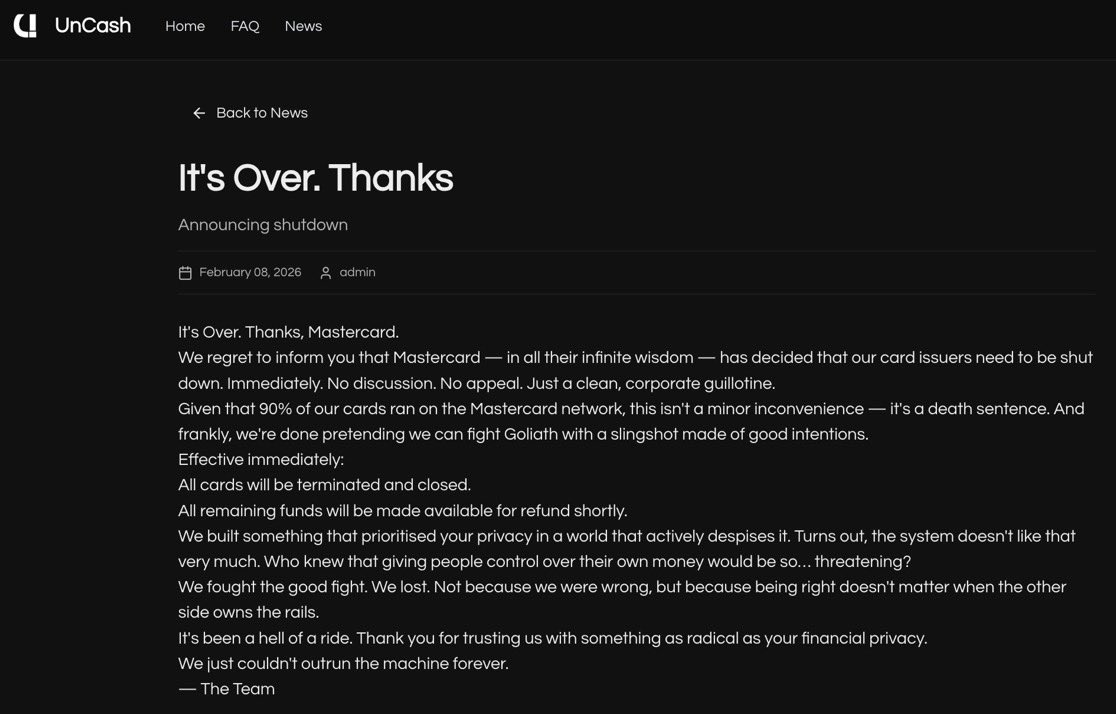

another no kyc crypto card provider bites the dust

same exact playbook i described in the article below

mastercard or the issuing bank decided they no longer have the risk appetite to deal with criminals and overnight the business you spent a year building falls apart

in this case UnCash had their license revoked by mastercard and now they’re saying user funds will be released

that’s probably true but i’d bet it takes 4-6 months, definitely not instantly

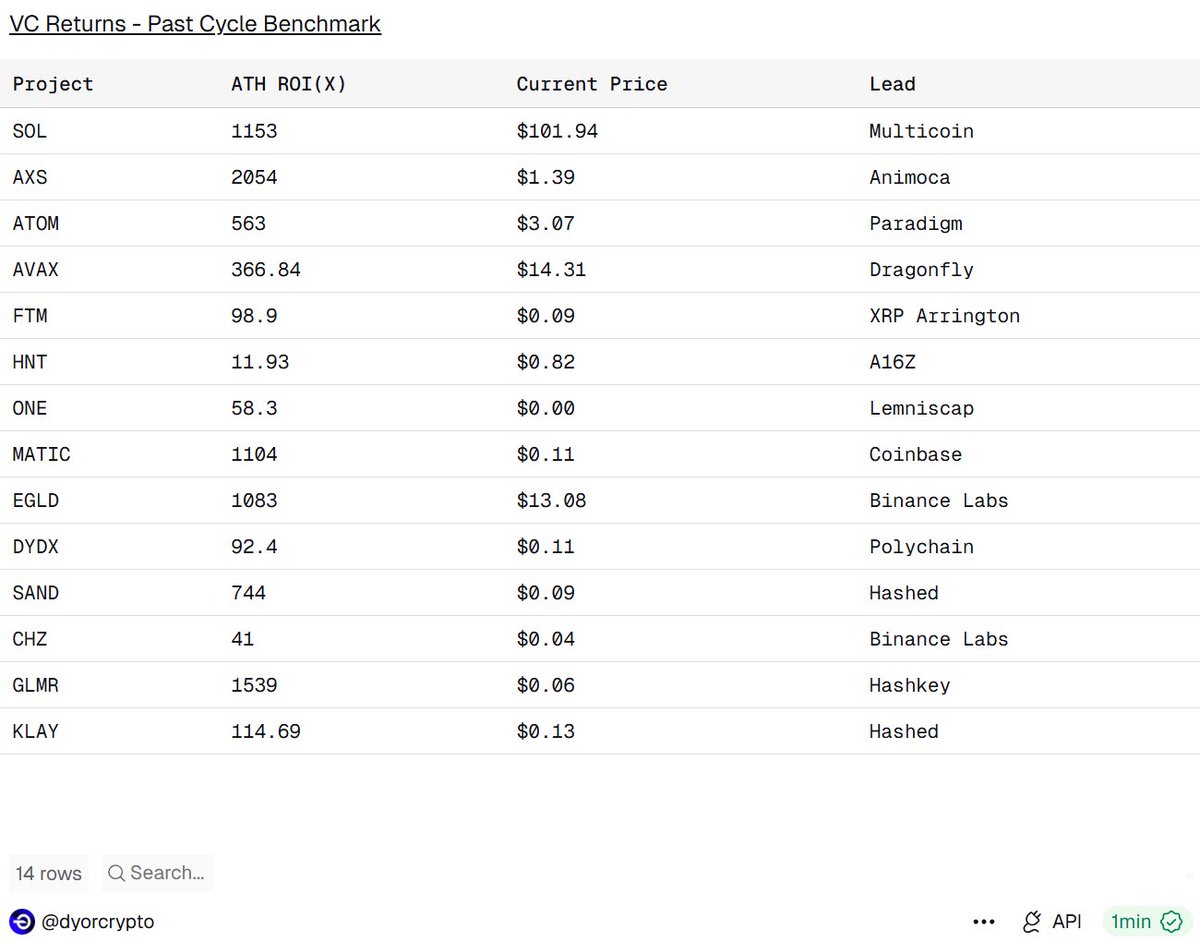

The shift from previous cycles has been brutal.

→ $AVAX produced a 366x, now one of the worst performers this cycle.

→ $ATOM produced a 563x; appchain thesis is dead; liquidity is fleeting.

→ $AXS produced a 2054x, no pmf, no adoption to sustain valuation.

→ $SAND produced a 744x; metaverse adoption did not materialize.

→ $GLMR yielded a 1539x, the Polkadot ecosystem failed.

The only token to outperform this cycle with growing fundamentals was $SOL (an ATH of $293 in Jan 2025), which also saw a 1153x return from its ATH.

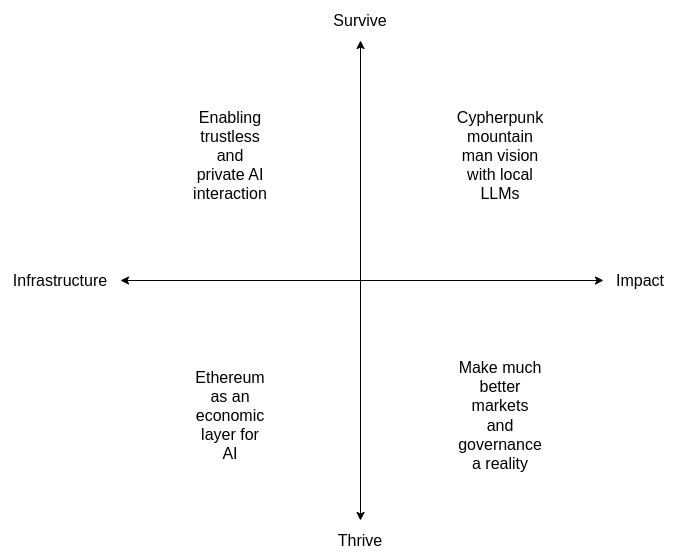

Two years ago, I wrote this post on the possible areas that I see for ethereum + AI intersections: https://t.co/y8G3MD5APF

This is a topic that many people are excited about, but where I always worry that we think about the two from completely separate philosophical perspectives.

I am reminded of Toly's recent tweet that I should "work on AGI". I appreciate the compliment, for him to think that I am capable of contributing to such a lofty thing. However, I get this feeling that the frame of "work on AGI" itself contains an error: it is fundamentally undifferentiated, and has the connotation of "do the thing that, if you don't do it, someone else will do anyway two months later; the main difference is that you get to be the one at the top" (though this may not have been Toly's intention). It would be like describing Ethereum as "working in finance" or "working on computing".

To me, Ethereum, and my own view of how our civilization should do AGI, are precisely about choosing a positive direction rather than embracing undifferentiated acceleration of the arrow, and also I think it's actually important to integrate the crypto and AI perspectives.

I want an AI future where:

* We foster human freedom and empowerment (ie. we avoid both humans being relegated to retirement by AIs, and permanently stripped of power by human power structures that become impossible to surpass or escape)

* The world does not blow up (both "classic" superintelligent AI doom, and more chaotic scenarios from various forms of offense outpacing defense, cf. the four defense quadrants from the d/acc posts)

In the long term, this may involve crazy things like humans uploading or merging with AI, for those who want to be able to keep up with highly intelligent entities that can think a million times faster on silicon substrate. In the shorter term, it involves much more "ordinary" ideas, but still ideas that require deep rethinking compared to previous computing paradigms.

So now, my updated view, which definitely focuses on that shorter term, and where Ethereum plays an important role but is only one piece of a bigger puzzle:

# Building tooling to make more trustless and/or private interaction with AIs possible.

This includes:

* Local LLM tooling

* ZK-payment for API calls (so you can call remote models without linking your identity from call to call)

* Ongoing work into cryptographic ways to improve AI privacy

* Client-side verification of cryptographic proofs, TEE attestations, and any other forms of server-side assurance

Basically, the kinds of things we might also build for non-LLM compute (see eg. my ethereum privacy roadmap from a year ago https://t.co/KdsQbpIkF9 ), but for LLM calls as the compute we are protecting.

# Ethereum as an economic layer for AI-related interactions

This includes:

* API calls

* Bots hiring bots

* Security deposits, potentially eventually more complicated contraptions like onchain dispute resolution

* ERC-8004, AI reputation ideas

The goal here is to enable AIs to interact economically, which makes viable more decentralized AI architectures (as opposed to non-economic coordination between AIs that are all designed and run by one organization "in-house"). Economies not for the sake of economies, but to enable more decentralized authority.

# Make the cypherpunk "mountain man" vision a reality

Basically, take the vision that cypherpunk radicals have always dreamed of (don't trust; verify everything), that has been nonviable in reality because humans are never actually going to verify all the code ourselves. Now, we can finally make that vision happen, with LLMs doing the hard parts.

This includes:

* Interacting with ethereum apps without needing third party UIs

* Having a local model propose transactions for you on its own

* Having a local model verify transactions created by dapp UIs

* Local smart contract auditing, and assistance interpreting the meaning of FV proofs provided by others

* Verifying trust models of applications and protocols

# Make much better markets and governance a reality

Prediction and decision markets, decentralized governance, quadratic voting, combinatorial auctions, universal barter economy, and all kinds of constructions are all beautiful in theory, but have been greatly hampered in reality by one big constraint: limits to human attention and decision-making power.

LLMs remove that limitation, and massively scale human judgement. Hence, we can revisit all of those ideas.

These are all things that Ethereum can help to make a reality. They are also ideas that are in the d/acc spirit: enabling decentralized cooperation, and improving defense. We can revisit the best ideas from 2014, and add on top many more new and better ones, and with AI (and ZK) we have a whole new set of tools to make them come to life.

We can describe the above as a 2x2 chart. There's a lot to build!

In the Backpack tokenomics, we have one guiding principle.

- Insiders "dumping on retail" should be impossible: no founder, executive, employee, or venture investor should receive wealth from the token until the product hits escape velocity.

Of course it begs the question, what does it mean to "hit escape velocity". Every project is different, and it's impossible to generalize. For Backpack, the answer is clear: we want to IPO in the USA. Going public might happen quickly, it might happen not so quickly, and in fact, it might not happen at all. In any case, we're going for it.

But before going public, we have to grow--a lot. The odd thing about Backpack's growth over the past year--and in fact one of the things that makes Backpack so different from basically every token project in crypto--is that, today, Backpack Exchange only serves about 48% of the world. We've been very slow, very intentional about opening up our product to the world, ensuring that we have every "i" dotted and ever "t" crossed as a regulated financial institution. Growth that sometimes feels like running with a parachute, but we are happy to take the long path, because it's precisely that parachute that will allow us to fly.

For those that don't know us, the reason for this is simple. Backpack is trying to not only build great crypto products, but we're also trying to build great TradFi products. We're trying to not only give our users access to every crypto asset, every blockchain, and every decentralized application, but we're also getting banking rails around the world, USD client money accounts in the USA, EUR in the EU, JPY in Japan--every currency on every major payment network you can imagine. We're trying to build a great securities product, whether that's getting access to your favorite stocks in a traditional brokerage or bidding on primary shares of a company about to go public on NASDAQ. We want to serve not only retail users worldwide, but we want to serve regulated products for regulated counterparties and regulated institutions around the world. All of this takes an enormous amount of time, effort, blood, sweat, and tears. We've been working on this for over three years at this point, laying an international foundation for the company and for the product slowly but surely, brick by brick. If we're lucky, we'll spend a lifetime.

What this all means is that, in the most literal sense--and I know this sounds silly--we're just getting started. We still have half the world to open up into. We still have some of our most exciting products to launch. And this leads to our next guiding principle in our tokenomics.

- Liquid tokens should exclusively go to users, fueling growth triggered by key product milestones.

Every time we open up a new region, every time we launch a new product, that's an opportunity to grow. Open up EU => grow. Open up Japan => grow. Open up the USA => grow. Open up predictions => grow. Open up stocks => grow. Open up card => grow. Like gasoline onto a fire, the token serves to continuously kickstart new markets in the same way points kickstarted Seasons 1-4.

With every growth lever we pull, tokens unlock in a predictable way to users, bringing in a new wave of token holders, growing the community, and allowing the product to soar to new heights. The objective constraint for this to work is precise: the value of added growth created by new token unlocks must always be greater than the dilution of those unlocks. As long as that condition holds, we can continue to unlock tokens direct to our most active users, growing along the way.

Last but not least is the question:

Ok so if all the liquid tokens are going to users, then what about the team? How exactly do you remain incentive aligned while ensuring the team cannot unlock, dump on retail, and become enormously wealthy without building something great?

And the answer is simple: not a single founder, executive, team member, or venture investor has been given a direct token allocation.

The entire "team allocation" sits in a "corporate treasury", i.e. on the balance sheet of the Backpack company--locked until at least one year post IPO. The team owns equity in the company, and the company owns a large percent of the token supply. It's not until the company goes public (or has some other type of equity exit event), that the team can earn any wealth from the project. It's not until the company has access to the largest, most liquid capital markets in the world by going public--and it's not until the company has done all the hard work to earn access to those markets--that the team can reap the rewards of the value created by the Backpack community from now until then.

We either go big, or we go home.

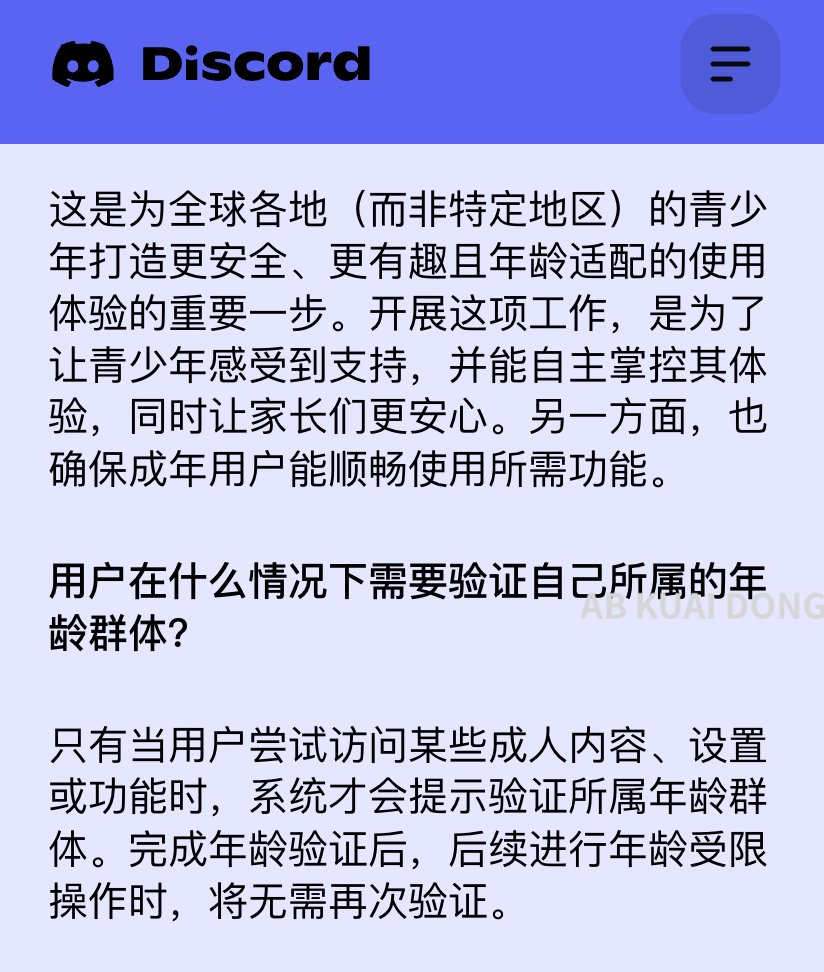

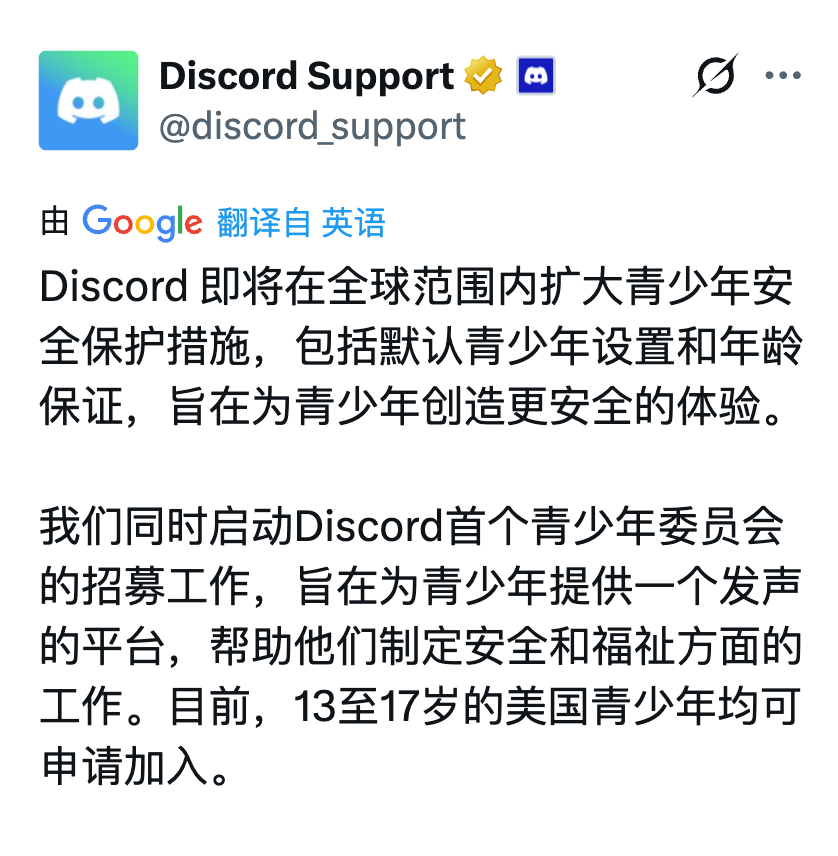

Discord 要 KYC 了?官方宣布下个月,如果不上传人脸扫描或身份证明,就会被限制使用一些功能。

根据规则,默认情况下,所有账号都会被当成青少年模式,直到完成以上认证。限制包括:

· 不能进入年龄限制的服务器

· 不能在 Stage 类频道发言

· 对敏感内容,自动开启过滤

· 来自陌生好友申请,会弹警告提示

· 非好友发来的私信,会被折叠请求

而想解锁这些功能,只能完成人脸识别,或上传政府颁发的身份证件。

BTC ETF 正在经历"死亡螺旋"⚠️:

从1700亿到不足1000亿,蒸发40%(约800亿美元)。

回想起来那个美好的2024年,关于加密原住民对比特币ETF的美好期待:

我们要的是"去中心化的黄金",可惜现在得到的是"被华尔街遥控的赌场筹码"。

更可怕的是加速度——1月净流出16亿,2月第一周就砸出3.6亿,单日最高5.45亿。

关键信号:ETF平均成本8.4-8.8万美元,而BTC现价6.5-7万美元,意味着所有ETF投资者集体浮亏15-25%。

当赎回触发砸盘,砸盘引发更多赎回,正反馈回路一旦形成,6万美元可能远远没到底。

你的仓位还撑得住吗?

日历

2 月 17 日

数据请求中

copyright © 2022 - 2026 Foresight News