TL;DR

- Why is Trump so eager to lower the interest rates? It could be the quickest way to suppress the government deficits.

- FOMC Meeting coming soon, with US GDP, core PCE, new home sales and other economic data in line to be released.

- Last week, the net inflow of BTC ETFs was $1.75 billion, proving that this decline is more due to external factors.

- Both the total market value of cryptocurrencies and BTC have shown a double top pattern, being cautious.

- Altcoins lack catalysts and the overall altcoins’ market is lacking momentum.

- Founder of Vine launches “commemorative token”, new SocialFi platforms launch on Solana. This week, 37 deals raised 110m, down 70% from the previous week.

Macro Overview

Why is Trump so eager to lower the interest rates? It could be the quickest way to suppress the government deficits.

When Trump openly demanded for lower interest rates during his video speech in Davos, he was sending a clear message to put pressure on Powell. Lowering interest rates echos with Trumps’ multiple goals including solving the government deficits dilemma, bringing back the manufacturing industry and reducing private sector’s debt pressure.

The anticipated federal government deficit will be $1.865tn in FY2025, surpassing 2024 level. The quickest part of government expenditure will be from the treasury interest payments, as a lower interest rate will save hundreds of billions of dollars. Meanwhile, Trump’s tax cut plan will reduce government income, so hitting down interest rates will be the quickest way to reduce government deficits in the short term. A lower interest rate will also encourage manufacturing industries to get back to the US, boosting PMI and helping the sector to walk into a positive zone. Private sector will also benefit from lower interest rates: considering that the newly issued corporate bonds amounted to $1.96tn, lower base rate will directly reduce the financing costs, further utilize the potential of the US capital market.

Despite Trump’s pressure, the market widely expected that the Fed will not change interest rates in the Jan 29th FOMC meeting — — on Ploymarket people are betting for a 98% chance of no change. A series of data will also be dropping since Jan 30th, including US 2024Q4 GDP, new home sales, Dec 2024 core PCE and personal income/spending data.

Compounding effects from Trump’s call for lower interest rates and his undecided policies on tariffs, the uncertainty level rose and the US dollar dives deeper downwards. This has become the worst week for dollar index performance since Nov 2023.

Mincor changes happened in the Fed’s total assets last week, as the overall level moved from $6.834tn to $6.832tn. Although the Jan 29th FOMC meeting is approaching and the market majority shares negative views about Fed’s decision of a rate cut, still in the mid to long term view the Fed is on schedule for a change of its asset controls policies.

Gold price climbed over 2.5% and landed at $2,770.80 last week, closing its all-time-high achieved in October. As President Donlad Trump’s push for lower interest rates and tariff threats weakens the dollar, gold price is set on rise.

Crypto Markets Overview

1. Main Assets

As of this Monday, the prices of Bitcoin and Ethereum were approximately $10,000 and $3,000, with a week-on-week decrease of 7.6% and 9.4%, respectively. The sharp decline this Monday was mainly due to the impact of the U.S. stock market crash, partly because the low training cost of the Deepseek R1 model disrupted the extreme supply-demand relationship for GPU chips.

Returning to the crypto market, altcoins remain very sluggish, with most experiencing flash crashes. Altcoins lack overall momentum, and there is still insufficient capital in the crypto space; new retail liquidity brought by $Trump is very limited.

2. Total Market Cap

The total market capitalization of the cryptocurrency market stands at $3.31 trillion this Monday. Excluding Bitcoin and Ethereum, the market cap amounts to $980 billion, reflecting increases of 4.8% and 6.6%, respectively.

Both the total market value of cryptocurrencies and BTC have shown a double top pattern, so readers still need to be cautious.

3. Net Inflows

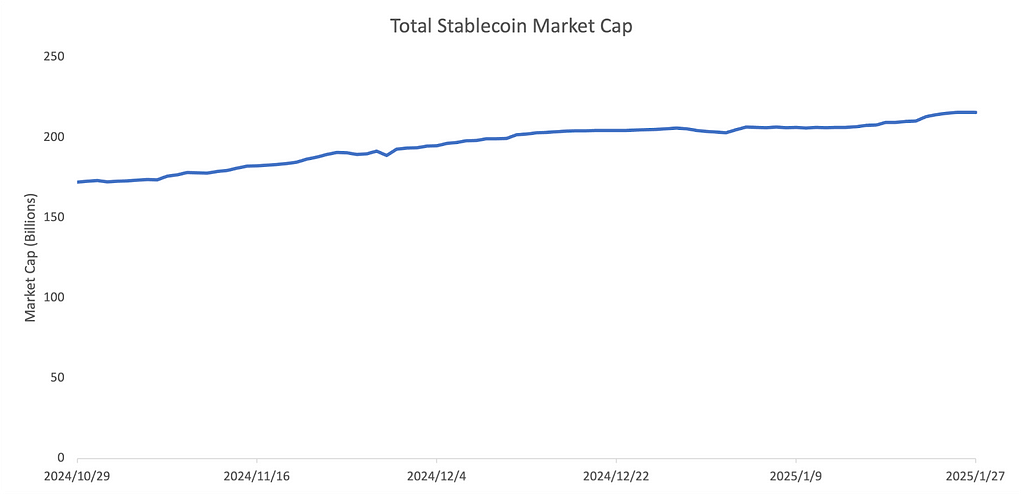

Last week, the total market value of stablecoins reached $215 billion, setting a new high for this cycle, with an increase of $5.5 billion compared to the previous week. The issuance was mainly concentrated in USDC, amounting to $3.8 billion. BTC spot ETFs saw an inflow of $1.75 billion last week, and ETH ETFs purchased over 42,000 Ether. This also proves that Monday’s decline was mainly due to the greater impact of external stock markets.

4. Top 30 Crypto Assets Performance

Most of the Top 30 tokens recorded declines last week, mainly due to external stock markets. However, BTC ETFs still recorded positive inflows last week. This week, it is necessary to continue observing the persistence of panic in external stock markets. In this round of decline, Trump fell by as much as 58%, and SUI dropped by 24%.

The Key Crypto Highlights

1. Founder of Vine launches Vinecoin

One of the founders of Vine, Rus Yusupov, has launched a “commemorative token” for the now-discontinued platform. Vine, a video-sharing app previously acquired by Twitter for $30m in 2012, was sunsetted in 2017. The app was an internet sensation which brought about the rise of celebrities such as the Paul brothers. The coin launched and endorsed by the founder has reached highs of $400m.

2. Clout.me and Tribe.run attempt to revitalise SocialFi on Solana

Clout.me by Ben Pasternak and Tribe.run by “billzh”, a developer from MIT, have launched their beta products. The two protocols are essentially derivatives of Friend.tech, the formerly popular app on Base which put into motion the idea of tokenised access keys to creators. On Clout, the founder’s token PASTERNAK reached a market cap of $80m while Tribe does not have a token, but allows for fractionalised keys.

3. Base lists TOSHI, ecosystem tokens see increased activity

TOSHI, one of the first coins on Base, has been listed by Coinbase, and surged over 1000% as a result. After 2 years of listing speculations, Coinbase has opened the door to listing memecoins from their own L2. Other tokens such as KEYCAT have seen small bounces in response to the news.

Key Venture Deals

1. SignalPlus secures $11 million in Series B funding

SignalPlus, an Asia-based provider of crypto trading software, has successfully raised $11 million in its Series B financing round, led by AppWorks and OKX Ventures, with additional participation from HashKey. The company specializes in institutional-grade trading tools, including products like QuantLab and the Trading Terminal, which are utilized by major exchanges and trading firms such as Binance and OKX. The company plans on using the funding to increase staffing and enhance their product offerings.

2. SOON raises $22 million in NFT mint

The SOON (Solana Optimistic Network) is designed to allow any Solana Virtual Machine (SVM) L2 solution to be deployed on any L1. Leveraging SVM’s parallel execution capabilities through the Sealevel runtime and an accounts model, SOON ensures efficient transaction processing without state conflicts. Their NFT round involved participation from Hack VC and Anagram, the public round selling out in 3 minutes. The SOON Public Mainnet is now live, featuring over 20 ecosystem projects and various bridging options for assets across blockchains.

3. Swarm Network raises $3 Million for multi-agent collaboration framework

Swarm Network has successfully closed a $3 million seed funding round, led by Y2Z Ventures and Zerostage, with support from a group of private investors. The company is focused on developing a “Multi-Agent Collaboration Framework” that enables individuals to own, manage, and monetize AI agents. This system converts single agents into collaborative swarms that can authenticate and secure real-time data on-chain and assign tasks to dedicated agents.

The number of deals closed in the previous week was 37, with Infra leading the way with 15 deals, representing 41% of the total number of deals. Meanwhile, Social had 3 deals, DeFi had 13, GameFi had 4 and Data had the least with 2.

The total amount of disclosed funding raised in the previous week was $110.13 million, with the most coming from Infra with $57.63m. GameFi deals did not disclose their raises, and thus the sector constituted the least funding.

Total weekly fundraising dropped to $110.13 million for the final week of January, a decrease of 70% compared to the week prior. Weekly fundraising in the previous week was down 30% year over year for the same period.

About Gate Ventures

Gate Ventures, the venture capital arm of Gate.io, is focused on investments in decentralized infrastructure, middleware, and applications that will reshape the world in the Web 3.0 age. Working with industry leaders across the globe, Gate Ventures helps promising teams and startups that possess the ideas and capabilities needed to redefine social and financial interactions.

Website: https://ventures.gate.io/

Twitter: https://x.com/gate_ventures

Medium: https://medium.com/@gate_ventures

【免责声明】市场有风险,投资需谨慎。本文不构成投资建议,用户应考虑本文中的任何意见、观点或结论是否符合其特定状况。据此投资,责任自负。