Ignas | DeFi

Twitter

观点

Sexy proposal by Aave Labs:

- 100% of the revenue to the DAO

- Aave branding IP given to a new Foundation

I've been critical of Aave Labs exactly due to value leakage from the DAO.

But this seems like a big compromise from Aave Labs that $AAVE holders should like.

Instead of revenue, Aave Labs would ask for an annual budget from the DAO.

I truly believe that whatever the amount, builders, BD, marketing etc. should be generously rewarded for their work.

We've seen what happens when builders are not paid well. Ethereum Foundation devs leave and join other well financed projects.

So Labs should not be in a position to beg the DAO for funding, especially as they cut their own revenue streams. Obviously with clear disclosures and transparency.

Although some questions arise on who actually controls the Foundation that rules over Aave branding.

A recent proposal that required disclosure of voting addresses was blocked by undisclosed wallets.

On the other hand, that's how 1 token = 1 vote governance works. If Aave Labs wants to maintain control over the foundation, they are incentivized to hold those tokens, not sell.

Or new buyers are incentivized to buy $AAVE if they want control over Aave IP.

Let the market decide.

Still, in light of this, I'd like to see clear disclosure that the granted 75k AAVE tokens would not be used for voting.

Finally, the proposed migration from v3 to v4 within 8 to 12 months seems too quick: users usually want to see a new version pass stress-testing before moving the capital.

But these smaller things can and will be adjusted.

Feeling optimistic about this.

Crypto isn't cool because we optimized for Boomers.

ETFs and regulation are necessary, but we sold out the original spirit to get them.

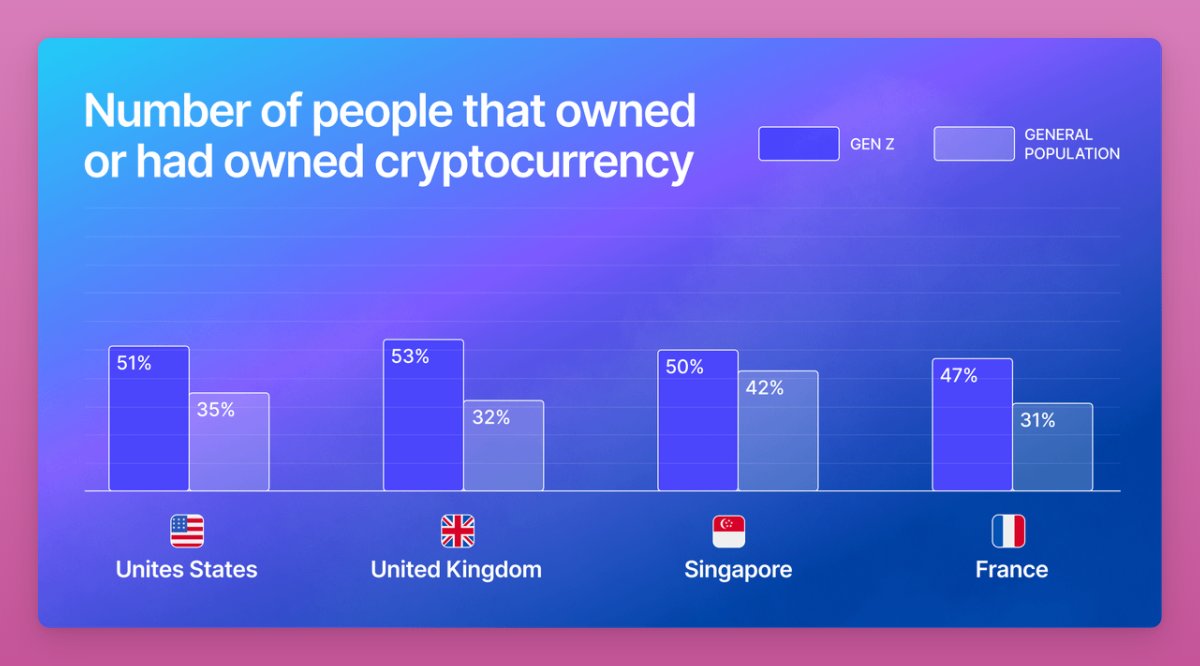

In the process, we sidelined the actual majority. 2025 Gemini survey found 51% of Gen Z owns crypto.

More than Millennials (49%) and Gen X (29%).

Even worse, by focusing on dumping on boomers, we've completely sidelined Gen Z.

They're cooked by tradfi, worried about AI taking jobs, unaffordable housing...

And crypto fails to offer a solution.

Now I bet that Gen Z is leaving crypto at the fastest rate. They got rekt on memecoins, NFTs, gamefi and every other retail oriented narrative.

So after we're done with regulation, let's focus on bringing Gen Z back.

Apps like PoolTogether is something we need more of. You could deposit some 10 USDC and win 100k. The only cost is the yield.

More importantly, crypto culture will need to shift from 'tech-first' to 'culture-first'.

The old motto of 'trustless' is confusing, and not sexy. Instead Gen Z trusts people, creators, more than cold code.

The shift is already happening as all technical narratives are dead. I used to write how ZK, restaking, or soulbound tokens work. No one cares about it now.

Even my beloved 'DeFi' focuses too much on 'low-risk' element that Vitalik mentioned instead of offering an escape from slave-waging.

3% or even 7% stablecoin yield on Aave doesn't make Gen Z exited. It's a product for rich millennials and boomers (who will use some vault wrapper on Aave).

Damn it, even Ethereum itself as a 'Layer 1 blockchain' lost its cool.

Reactions to Coinbase ad on Super Bowl are telling.

-----

Hope Mr. Beast's acquisition of Step is a start of Gen Z-Fi.

However, we need to address issues in crypto from all angles to bring them back:

- Gen Z trusted influencers who exploited them the most.

- Pump fun and similar apps that were supposed to bring 'creator revenue' ended up extracting value instead of creating it.

- Perps that on paper bring fast money ended up literally liquidating most active crypto user base.

Finally, I hope we succeed in making crypto cool again.

Coz I am getting bored of crypto myself.