1. Q3 2024 Investment Strategy

In Q3 2024, Web3Port Foundation continues to focus on supporting revolutionary Web3 projects, particularly those with long-term potential and the ability to reshape industry landscapes significantly. We view Web3 not only as a technological innovation but also as a key force driving creativity and transformative changes in production relationships. As such, Web3Port Foundation remains actively involved in various sectors, including DeFi, AI, DePIN, and Payments. Empowering projects capable of leading industry development and delivering real value will drive the growth and advancement of the entire Web3 ecosystem.

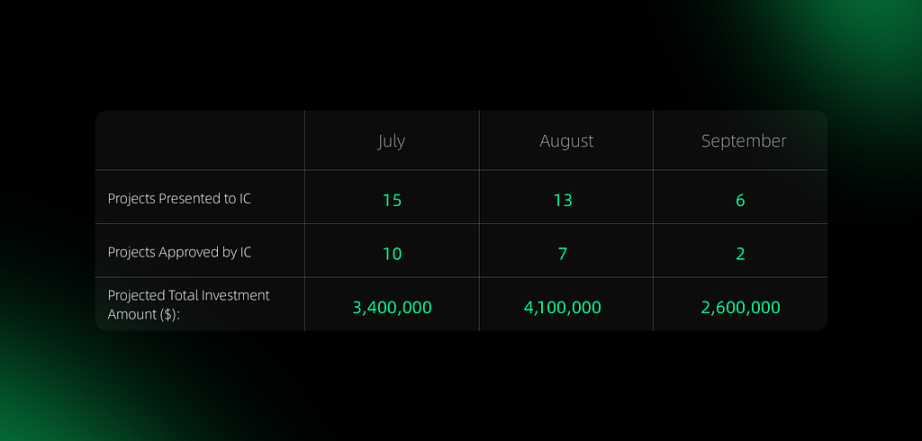

2. Overall Performance Data

In Q3 2024, Web3Port Foundation conducted a thorough scanning and screening of 650 projects. Of these, 212 projects passed the initial screening, representing 32% of the total. After in-depth research and comprehensive investigation, 34 projects were brought to the IC for discussion, accounting for 16%. Ultimately, 19 projects were successfully invested in, representing 8.9% of the total, with a total investment amount of $10.1 million.

The overall activity in the Web3 primary market saw a decline in Q3, with market sentiment relatively subdued. While industry VCs remained interested in projects, the overall uncertainty led to a more cautious approach. This market cooling resulted in some anxiety among both entrepreneurs and investors. However, the Web3Port Foundation remains steadfast in its long-term belief in the development opportunities within the Web3 industry, continuing to maintain a high frequency of investments and substantial capital deployment. We firmly believe that the transformative potential of Web3 technology is immeasurable, and true innovation and breakthroughs will come from those projects that dare to move forward despite the challenges. Therefore, we encourage Web3 entrepreneurs to stay motivated, persevere through difficulties, and continue to push the boundaries of cutting-edge technologies and applications.

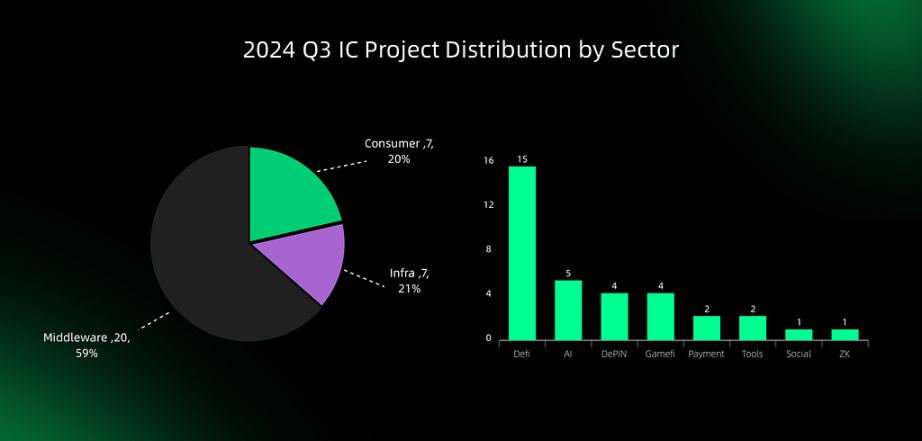

Project Distribution Reflects W3P’s Investment Strategy. The distribution of projects under review continues to highlight W3P’s core investment strategy, with a primary focus on both early-stage pre-seed/Seed projects and high-quality, mature pre-listing projects. This approach emphasizes certainty throughout our investment journey and is increasingly shaping a pyramid-like structure that links early-stage innovation with later-stage market readiness in a cohesive, reinforcing layout.

Web3Port Foundation classifies all projects into three main categories: Infra: Projects that provide essential technological infrastructure, hardware, and tools for Web3, such as L1/L2 (Movement, Bitlayer), AI computing power (Aethir), and ZK technology services (Zerobase). Middleware (App/Dapp): Projects that connect infrastructure with applications, offering support to upper-layer applications or users by enabling the sharing of information, resources, and liquidity across different infrastructures. Examples include the DeFi trio: Jupiter, Echelon, and Trusta. Consumer: Projects with a core business model serving end-users (C-end), where user contributions generate the greatest commercial value. Examples include UXLINK and Wildforest.

- The IC projects primarily focus on Infra and Middleware, which have higher technological barriers and greater market ceilings.

- Given Web3’s inherent financial attributes, DeFi projects remain the dominant category for IC projects, followed by AI, DePIN, and GameFi-related projects.

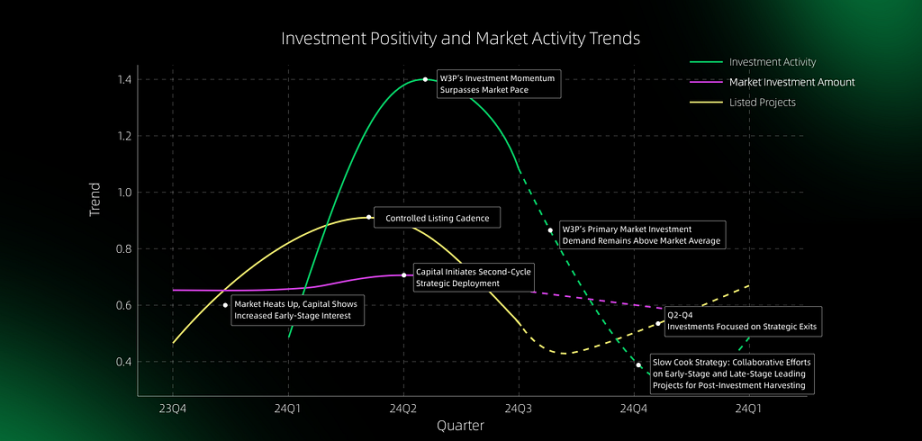

Annotations for the Above Chart:

All curves in the chart are abstracted from multiple values proportional to the “heat trend value.” The dashed lines after Q3 represent projected values.

• Investment Activity: This is composed of data related to Web3Port Foundation’s investment heat, number of invested projects, investment amounts, and other relevant datasets.

• Market Investment Amount: This is based on actual investment amounts and the number of projects in the Web3 primary market, compiled from public data.

• Listed Projects: This is a weighted average of actual listing project data from five major exchanges (Binance, Okx, Bybit, Kucoin, Bitget).

3. Thoughts and Insights on Key Sectors

On AI:

For next year’s market outlook, there is a strong consensus among top-tier VCs that the AI sector will see significant growth. Some projects in this sector have already been launched this year with solid investment backing, causing a surge of “hype-driven” and “shovelware” projects in the primary market. However, true blockchain-related AI projects, distinct from traditional AI, have yet to emerge. The market is actively seeking decentralized applications for AI, with some promising ideas such as combining decentralization with distributed computing power, integrating tokenomics with AI-driven market applications, and building AI infrastructure on public blockchains. This thought process continues to evolve, with growing interest in integrating AI agents with personal traits, payment transfers between AI agents, verifiability of AI paths, and the creation of distributed storage environments for AI.

On DePIN:

The DePIN sector adheres to Web3’s logic of utilizing decentralization and transparency to enhance the scalability and efficiency of infrastructure. By leveraging crowdsourced resources, DePIN avoids large-scale capital investments from centralized players, making it more suitable for real-world business applications. As DePIN projects have evolved, they have moved beyond pure mining-based models. Projects like Aethir and Akash are now generating significant business revenue, reducing their reliance on token liquidity. The dual revenue streams from hardware sales and business income allow these projects to operate more sustainably, making them more appealing to investors and exchanges.

DePIN projects are also shifting from single-resource aggregation to more complex resource pooling models, such as combining storage with computation and sharing bandwidth for computing acceleration. While these projects are still concentrated in infrastructure, they are increasingly appearing as upstream components for AI. The explosion of AI narratives is likely to bring additional attention to the DePIN sector. Potential sub-sectors include decentralized infrastructure, middleware, Edge AI, and consumer-grade products like wearables. DePIN projects share the common need for community and grassroots sales networks to distribute mining equipment, and exploring how to integrate these networks into the core of our capabilities is an exciting direction.

On Ordinary Investors & Meme Tokens:

The primary objective of ordinary investors is to achieve returns. After the ICO and DeFi Summer, the market has yet to offer strong opportunities for returns. However, stories of windfall gains always persist, much like the appeal of a casino to gamblers. This year, the focus has been on Meme tokens like Pump. fun and zero-cost “knock knock to earn” airdrop plays in Telegram communities. Moving away from VCs and CEXs reflects the true sentiment of retail investors. Nevertheless, we believe that the professional eye of VCs will bring projects that can generate real profits for these investors, and Web3Port Foundation aims to fulfill this mission.

The Meme sector has also begun to see a decentralized “conspiracy group” formed by project founders, market makers, KOLs, early discoverers, and promoters. The proportion of Meme tokens controlled by these groups has increased significantly. Meme tokens are no longer just assets for chain-based PVP (player vs player) games. For projects that are not purely Meme-oriented, Meme tokens are now becoming tools for brand promotion and increasing community engagement, with traditional project operations merging more closely with Meme elements.

Conclusion:

In Q3, we remained committed to providing the market with support within our capabilities. Our primary focus was on AI, DeFi, and infrastructure sectors, where we formed deep partnerships with multiple public chains. These efforts have planted seeds for potential breakout projects in the future, and we firmly believe that the market will offer more opportunities.

With the U.S. elections now settled, we see a renewed policy direction and market liquidity returning to Web3, which is exciting. We are confident about Q4 and will continue to provide full-spectrum support, including but not limited to capital, to promising and valuable projects. We welcome you to contact us.

About Web3Port Foundation:

Web3Port Foundation is an international, multi-stage technology investment fund focused on driving blockchain innovation and supporting Web3 enterprises with competitive differentiation to establish and grow in the global market. Web3Port Foundation currently manages a $100 million primary fund and a $1 billion secondary fund. In just six months, we have invested in over 40 projects, totaling more than $25 million in investment. Our portfolio includes Aethir, UXlink, and CARV, all of which are listed on top-tier exchanges such as Upbit, OKX, and Bybit.

【免责声明】市场有风险,投资需谨慎。本文不构成投资建议,用户应考虑本文中的任何意见、观点或结论是否符合其特定状况。据此投资,责任自负。