Author: PSE Trading Trader @MacroFang

Fed Signals End of Rate Hikes Era, Shifts to Cuts from 2024

Powell: We are Near or are at Peak Rates

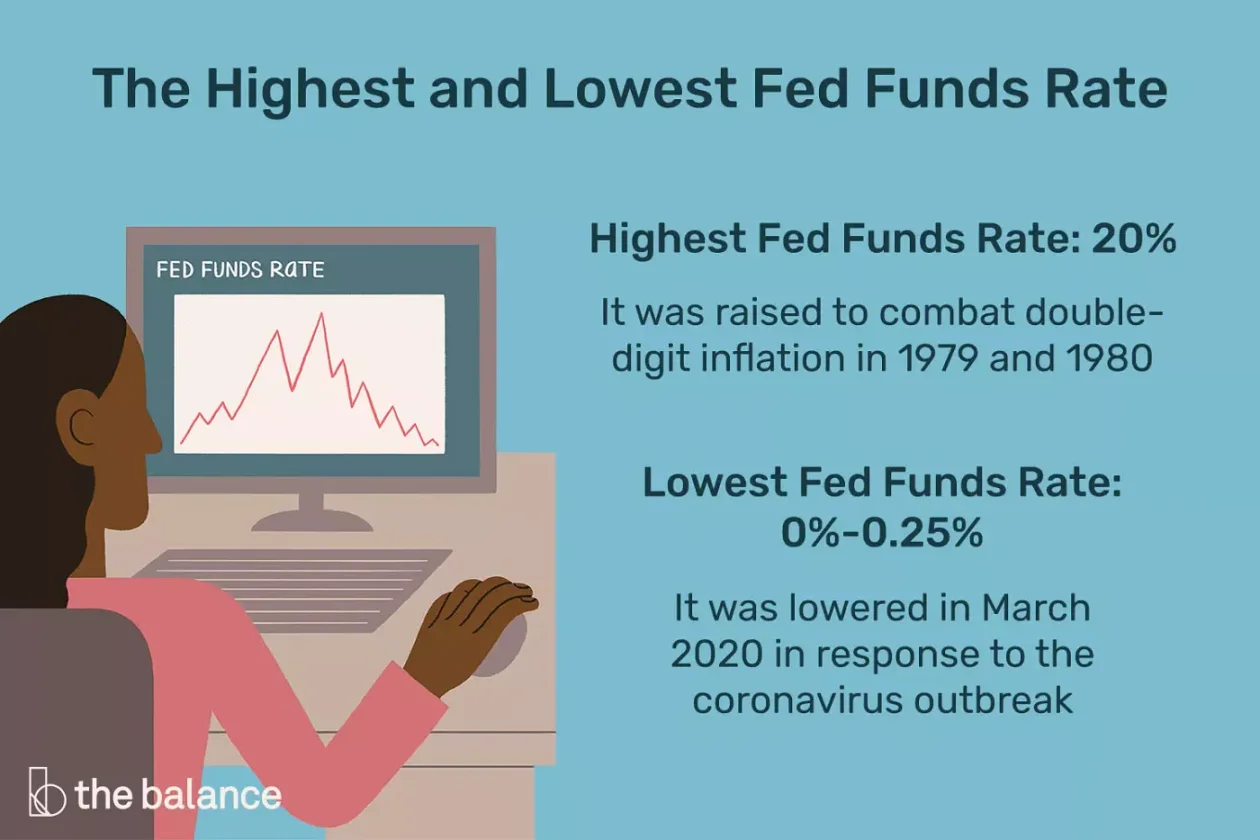

The Federal Reserve has for the third time maintained its interest rates, indicating an end to its aggressive rate hike campaign, and forecasting a sequence of cuts starting in 2024. In a unanimous decision, the officials consented to retain the benchmark federal funds rate at 5.25% to 5.5%, marking the highest level since 2001. For the first time since March 2021, no further increases in interest rates were projected, based on median estimates.

Beginning of Rate Cut = Beginning of Market Rally

An interest rate cut is generally considered as fuel for the market. To understand this, one can look at the 2020 rate cut to 0% during the COVID-19 pandemic which subsequently led to a rally in the S&P Index. Lower interest rates make borrowing cheaper, thereby encouraging businesses to invest and consumers to spend.

Fed’s 2024 Rate Cut Plan: 75 basis points next year

The Federal Reserve expects to cut rates by 75 basis points next year, a significantly faster pace than what was suggested in September’s projections. The median forecast for the federal funds rate at the end of 2024 was 4.6%, although individual expectations varied widely. Eight officials predicted fewer than three quarter-point cuts next year, while five foresaw more.

Fed Chair’s Remarks: Rate Hike Likely Over

Chair Jerome Powell made it clear that these projections do not constitute a pre-set plan. He kept open the possibility of further interest-rate hikes, if needed, to control any surge in price pressures. Nevertheless, he did confirm that interest rate cuts were considered during this week’s meeting.

In early December, Powell cautioned against market expectations for a rate cut in Q1 of next year, stating it would be too soon to determine if the policy stance is restrictive enough or to predict when policy might ease. Both Powell and other policymakers agree that the journey to achieve a 2% inflation target will be rocky. Policymakers have pledged to keep rates high long enough to ensure price inflation returns to target, leading market participants to expect rate cuts as early as March.

Alongside lower inflation forecasts for this year and the next, the Fed’s preferred price measure (excluding food and energy) is predicted to rise 2.4% in 2024. Economic growth for next year was slightly revised down, while unemployment projections remained the same.

Impact on Treasury Yields

Treasury yields have been reduced significantly in recent weeks, effectively wiping out the increase seen throughout the summer and into October. The significant tightening of financial conditions may reduce the need for further interest rate hikes. The drop in rates has begun to impact the economy, lowering mortgage rates and triggering an uptick in recent demand to refinance and purchase homes.

3 Tailwinds for Bitcoin & ETH

The potential interest rate cut by the Federal Reserve could have a significant impact on not just traditional financial markets but also digital asset markets, particularly Bitcoin and other cryptocurrencies.

We see 3 Tailwinds for BTC & ETH:

ETF Approval

BTC Halving

Fed Rate Cut

In a low interest rate environment, investors often search for assets with higher yields to achieve the required returns. This environment could be beneficial for Bitcoin, a non-interest-bearing asset, as it becomes an attractive investment alternative due to its potential for high returns.

Historically, Bitcoin has performed well in low interest rate conditions because of its decentralized nature and potential for significant price appreciation. The 2020 rate cut to 0%, a reaction to the COVID-19 pandemic, saw Bitcoin’s price skyrocket as it was seen as a hedge against inflation and a store of value in an uncertain economic climate.

Rate Cuts = Long Risk Assets

Lower interest rates also bode well for other risk assets. Companies can borrow money at low rates, leading to increased capital investment and growth. This situation can stimulate the stock market and boost the value of risk assets. Conversely, assets seen as safer, such as bonds, may see less demand, as their comparatively lower yields become less attractive.

In conclusion, while the Federal Reserve’s potential interest rate cut in 2024 will have broad implications for a range of financial markets, it could particularly benefit Bitcoin and other risk assets by creating a favorable investment environment.

【免责声明】市场有风险,投资需谨慎。本文不构成投资建议,用户应考虑本文中的任何意见、观点或结论是否符合其特定状况。据此投资,责任自负。