Author: PSE Trading Trader @MacroFang

Binance and CEO Admit Violation, Settle Fines

FUD Cleared: Binance and CEO Admit Violation, Settle Fines

Binance and its CEO Changpeng Zhao have pleaded guilty to anti-money laundering and US sanctions violations, leading to a massive \(4.3 billion settlement with the US, one of the biggest in corporate history. Zhao himself will pay a \)50 million fine and step down as CEO. These resolutions end a long-standing investigation into the exchange’s failure to prevent suspicious transactions with terrorist outfits and allowing transactions between customers in the US and Iran.

In 2019, Binance, the world’s largest cryptocurrency exchange, and its then-Chief Compliance Officer, Samuel Lim, acknowledged that the platform was used to funnel money to terrorist organizations such as Hamas. The US Commodity Futures Trading Commission filed a lawsuit against the company and its CEO, Changpeng Zhao, which resulted in a \(4.3 billion fine and Zhao’s guilty plea for failing to comply with anti-money laundering laws. As part of the settlement, Binance will be required to report suspicious transactions moving forward and review past activity that should have been disclosed. The Financial Crimes Enforcement Network (FinCEN) will receive \)3.4 billion of the fines paid by Binance, marking the largest fine in FinCEN’s history.

New CEO: Bullish

Zhao’s resignation as CEO and Richard Teng’s entry as his successor signal a new era for Binance with an emphasis on compliance. With the legal issues now resolved and a clear path set for improved regulatory adherence, the perceived risk for the crypto market has been reduced. This removal of a significant headwind can be considered bullish for Bitcoin, potentially promoting increased investor trust and market stability.

Halving = Prospect of a $220,000 Bitcoin

Bitcoin’s block subsidy halving, occurring approximately every four years, is a key event for investors. This process, which halves Bitcoin’s supply inflation, is typically a strong bullish signal for Bitcoin’s price.

Bitcoin Archive forecasts Bitcoin to surpass $220,000 within 18 months, based on the sixfold price increase seen post-halving previously. But, with each halving seeing a diminished price surge, this prediction must be taken with caution. Ultimately, while Bitcoin’s halving events are generally a bullish signal, market volatility and the diminishing returns seen in previous halvings should temper expectations.

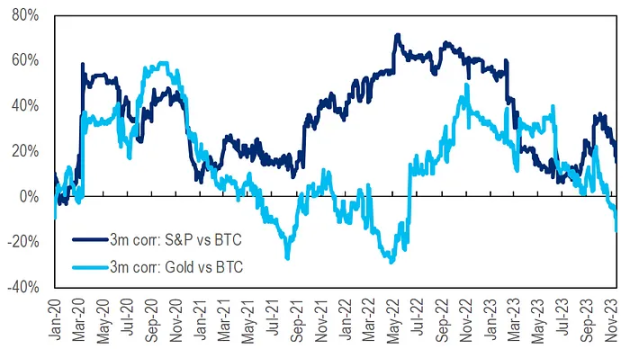

Crypto vs S&P Correlations: Breaking Off

There has been a dramatic decrease in crypto-equity correlations this year, which initiated with the divergence of crypto-equity after Silvergate’s failure. This has likely led to increased interest in the DeFi sector. Current 1m correlations are significantly lower than in early September, with BTC’s and ETH’s correlations with S&P now in the negative. Despite the decline in broader banking stress, 3m correlations are nowhere near the levels of late 2022 and early 2023.

The global crypto market cap has grown by approximately 79% YTD and BTC volumes are on the rise again. After a downturn from March to mid-October, volumes saw a spike at the end of last month. Although the increase was short-lived, volumes are recovering and are now about 14% below the 2022 average. Additionally, this year’s crypto rally has led to an increase in Bitcoin dominance, currently stabilizing around 50%, with further potential growth due to possible SEC approval for spot Bitcoin ETFs.

YTD, crypto returns have been stronger during US trading hours, outpacing other time zones. The surge in US returns began with the US CPI release in January, which initially indicated the first month-on-month decline since the onset of the pandemic. Returns during US trading hours received the most significant boost from heightened ETF optimism in June and October, especially for BTC. YTD, Bitcoin returns have been strongest during US hours, while Ethereum returns have significantly lagged during EU trading hours.

Search interest in Bitcoin and Ethereum has started to increase, showing correlation with price action and idiosyncratic events, such as the 2022 FTX and LUNA collapses.

Crypto Performance Amid Rising Volatility

The volatility of multiple assets has seen an increase, and cryptocurrency seems to be no exception to this trend. Despite the volatility adjustment, cryptocurrencies, especially altcoins, have consistently outperformed others. This surge aligns with the improving metrics including an increase in Bitcoin volumes, Google search interest, and the market caps of stablecoins following several months of downturns. The rally is also concurrent with the soaring inflows of Bitcoin ETP. Analyzing the effect of the launch of GLD, the first gold ETF, on the precious metal, could reveal significant insights due to the similarities between gold and Bitcoin, one of which is the accessibility issue for investors.

The Potential Impact of Easier Access to Bitcoin

Similarities between Bitcoin and gold, particularly as non-interest-bearing assets, can lead to pertinent market implications. Both were assets that resisted ease of access to a majority of investors, but the desire for this access was certainly present. For gold, especially physical bullion, this changed with the introduction of a gold ETF that meticulously tracked the spot prices and offered effortless exposure for both institutional and retail investor communities. The launching of a spot Bitcoin ETF is becoming more likely, hence the analysis of the impact the first gold ETF had on the respective asset.

Gold ETF Inflows vs. Relative Outperformance

The first gold ETF, SPDR Gold Shares (GLD), was launched on November 18, 2004. Post-launch, gold slightly outperformed silver for a week before this trend was quickly reversed. Subsequently, gold saw a substantial outperformance before also reversing. Despite the underwhelming performance of gold relative to other commodities, inflows into GLD were very significant, leading to an overall rally of the precious metals complex. Within the first year since its inception, the market cap of GLD grew nearly 500%. So, despite the relative price performance, inflows clearly indicated the demand for gold exposure that the GLD launch satisfied, at least partially.

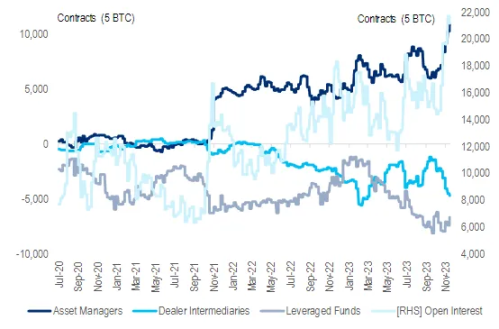

Market Optimism Towards Spot Bitcoin ETF Approval

When the initial speculation of ETF approval started in June, the influx into Bitcoin ETPs surged significantly. The renewed optimism for SEC approval has sparked another round of inflows, which seem to be growing at an even faster pace compared to the previous period. Notably, the rate at which asset managers have been purchasing Bitcoin futures has risen significantly. This is also evident in ETH futures activity. The demand for Bitcoin ETFs was also evident in the cryptocurrency’s sharp rally following erroneous reports of SEC approval. However, the extent of Bitcoin demand to be unleashed upon ETF approval is highly uncertain. This uncertainty will only rise if approval becomes delayed even further. It’s plausible that investors who are already capable of acquiring BTC are accumulating in anticipation of approval, only to sell once SEC approval is granted.

【免责声明】市场有风险,投资需谨慎。本文不构成投资建议,用户应考虑本文中的任何意见、观点或结论是否符合其特定状况。据此投资,责任自负。