Author: PSE Trading Analyst @Daniel

Introduction

As the blockchain industry has evolved, the Defi sector has matured significantly, with lending being a core component. During bull markets, lending often serves as the fuel that ignites market trends. Investors frequently collateralize BTC, borrow USDT, and then use it to purchase more BTC, which drives market rallies and gains excess returns. However, as the cryptocurrency market frenzy subsides, the decline in BTC prices often leads to a cascade of liquidations, pushing BTC prices to critical levels. In pursuit of the goal of an “eternal bull market,” the market has introduced many “non-liquidation” protocols. These protocols aim to allow investors to enjoy excess returns without facing the risk of liquidation. This article will examine several common “non-liquidation” protocols in the market. To be clear, the so-called non-liquidation essentially involves risk transfer. While investors profit, someone else bears the risk.

1. Differences in Non-Liquidation Protocols

1.1 Early “Liquidation” Using Other Collateral Assets

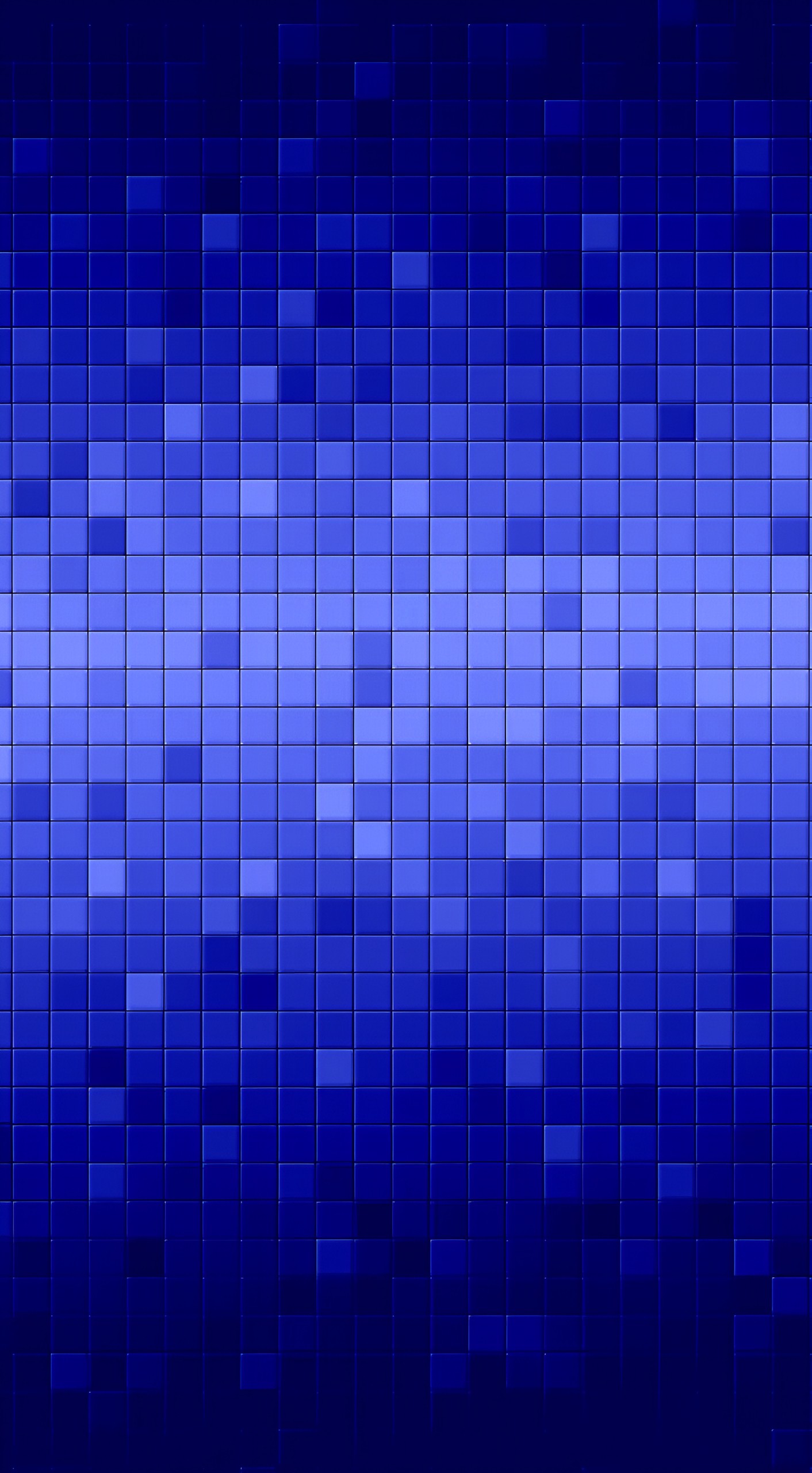

Thorchain serves as a typical representative in this category. Thorchain is a cross-chain protocol that establishes various asset pools on different chains, such as BTC/RUNE (with Rune as the platform coin). When users need to cross assets, they exchange BTC on the Arb chain for Rune, then exchange Rune for ETH on the OP chain. During the lending process, BTC needs to be exchanged for Rune, Rune is burned to generate Thor BTC (synthetic asset), Thor BTC is then exchanged for Thor TOR (official stablecoin), and finally burned to mint Rune, which is ultimately exchanged for USDT. Throughout this process, Rune is gradually deflated as it is burned to generate USDT, and users must pay swap fees to LP each time. Unlike traditional lending protocols, users ultimately “collateralize” USDT to borrow USDT, eliminating concerns about BTC price fluctuations. This results in no “liquidation” events, or in other words, a “liquidation” has been preemptively carried out.

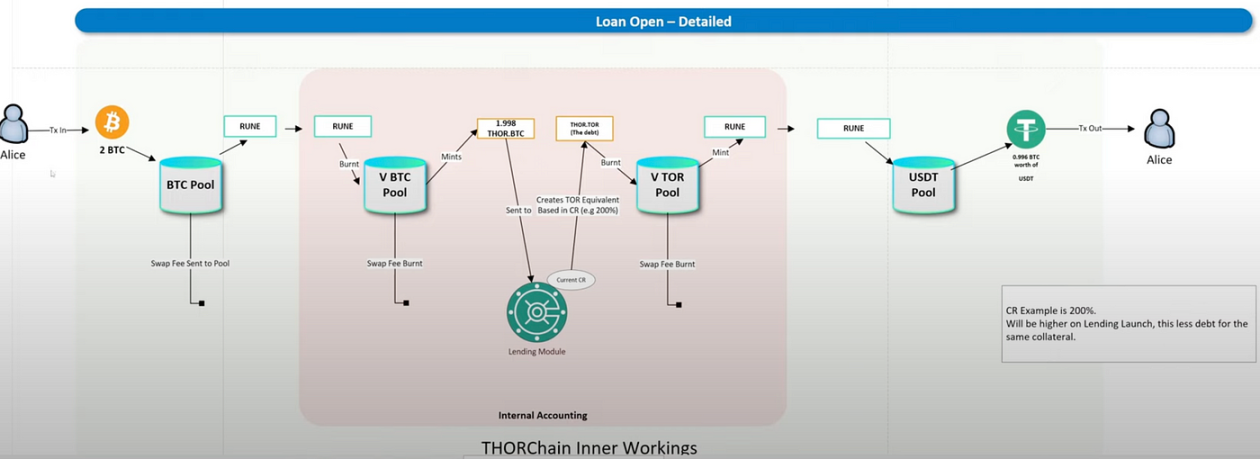

If the protocol has no “liquidation” and no interest, borrowers can potentially avoid repaying the loan indefinitely. However, an extreme scenario arises during a bull market when borrowers, driven by the rise in BTC prices, may choose to repay the loan to reclaim more BTC profits. The process is as follows: Convert USDT to Rune > Burn and Mint Rune into Thor TOR > Exchange Thor TOR for Thor BTC, then burn to generate Rune > Finally, swap Rune back to BTC to repay the loan. In this process, Rune becomes the major variable. Minting Rune to retrieve collateralized BTC can lead to the creation of an “unlimited” supply of Rune, ultimately resulting in a collapse if too many borrowers choose to repay.

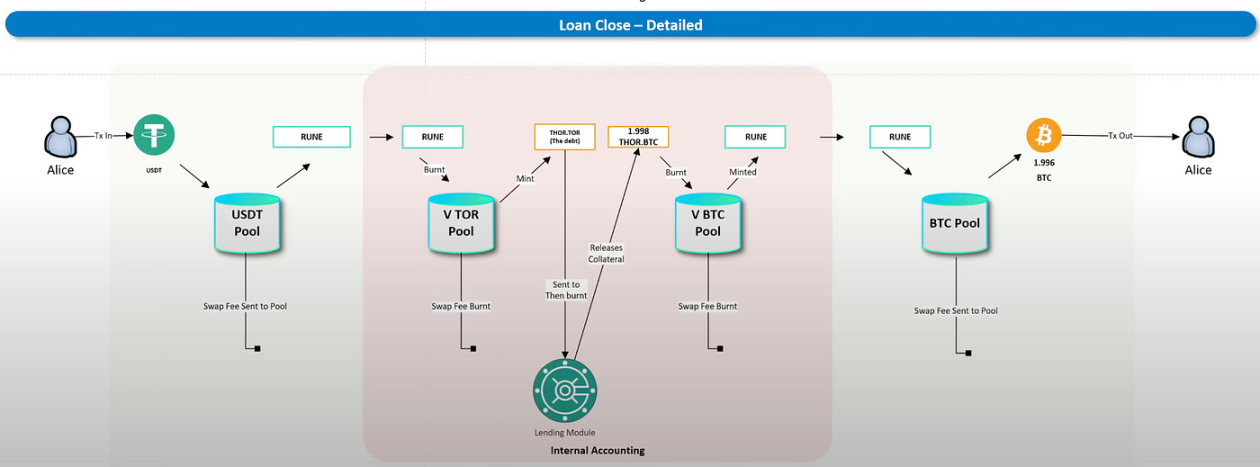

Hence, Thorchain has established a maximum Mint limit, which is the debt ceiling, currently set at 500 million. The native Rune supply is 485 million, which allows for the Minting of up to 15 million Runes. Thorchain sets the value of the Lending Level to ultimately multiply and equal the quantity of Runes that can be burned. Based on the current price of Rune, one can determine the USDT value that can be borrowed.

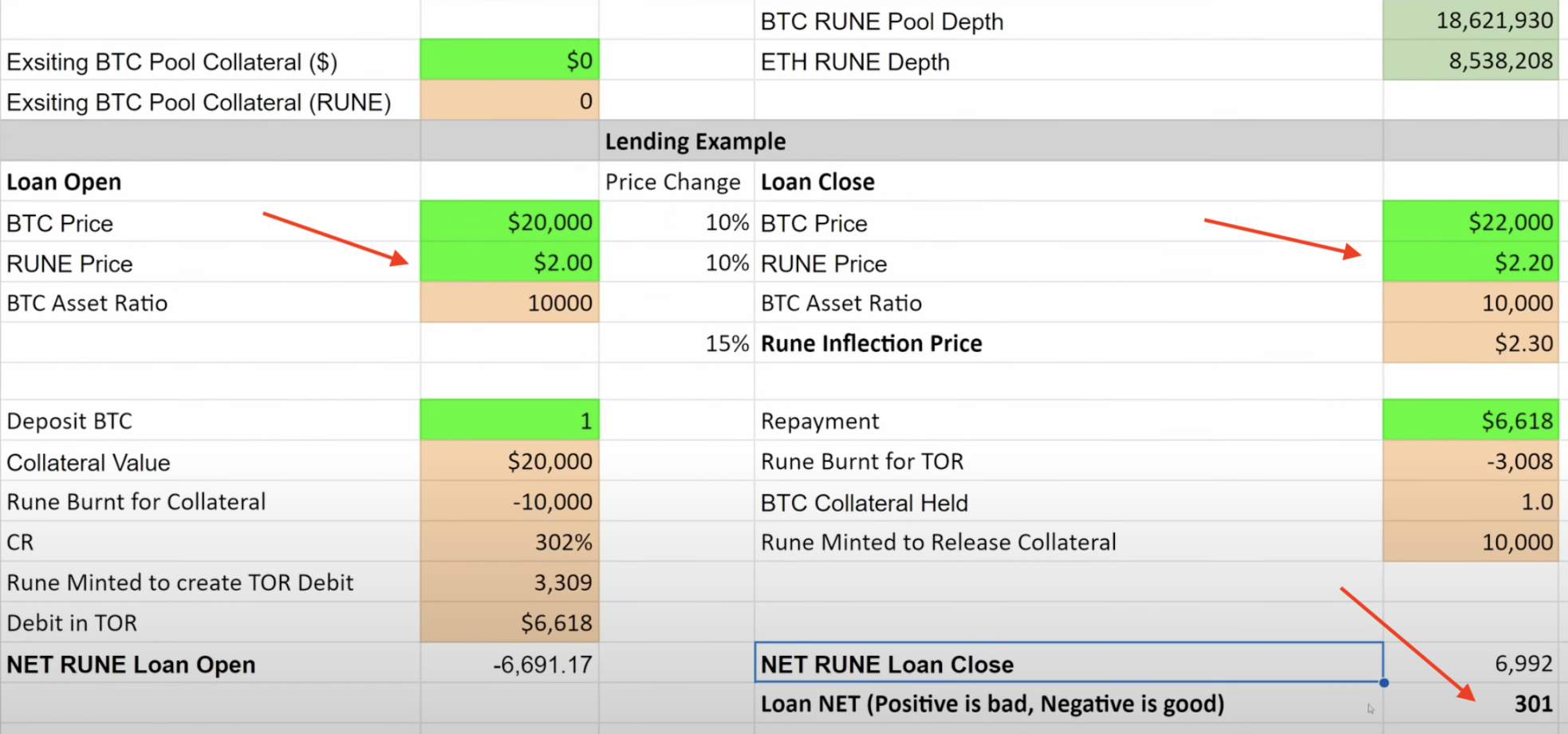

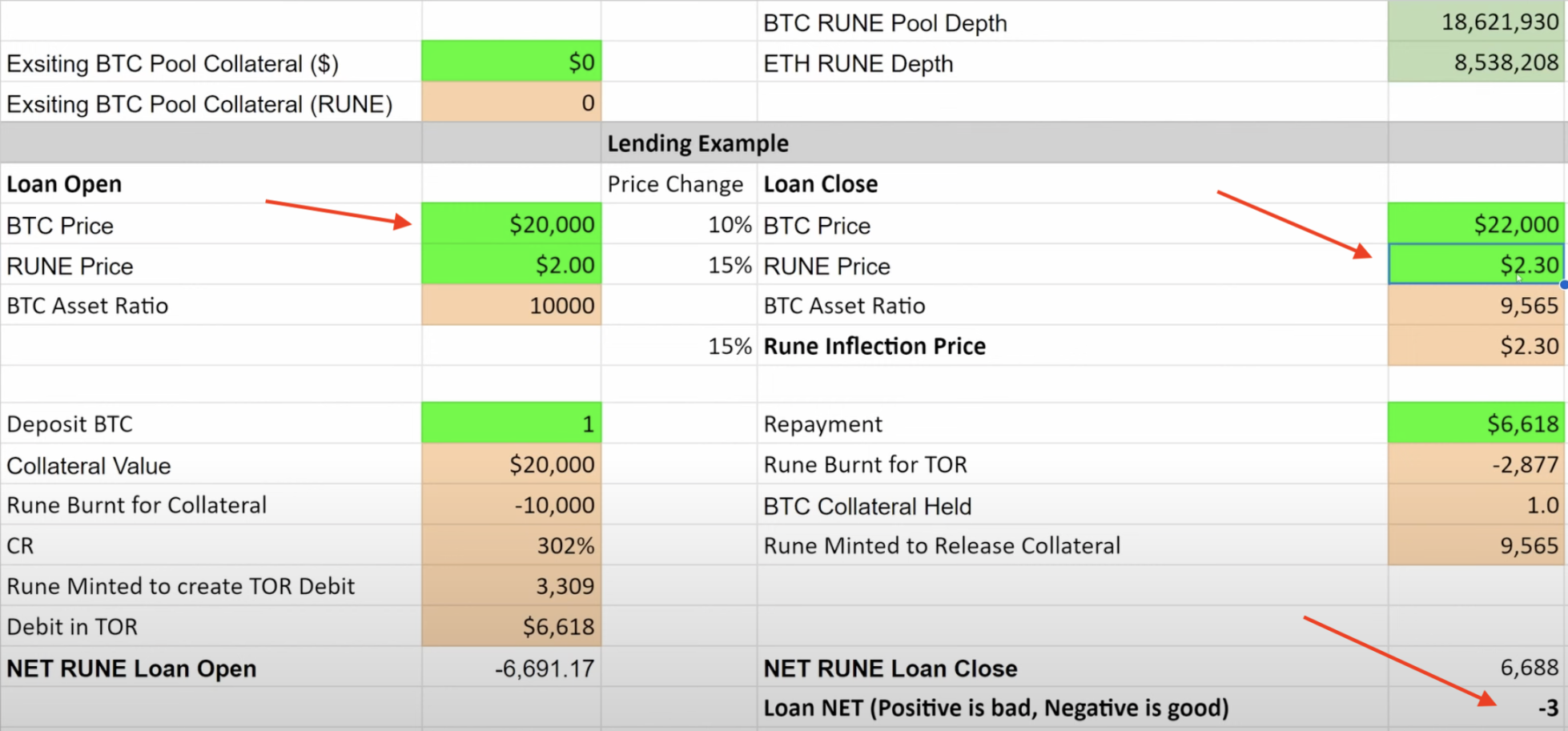

Furthermore, the price relationship between Rune and BTC is crucial to the success of the protocol. The following two charts illustrate that when both BTC and Rune prices rise by 20%, users will Mint the additional 301 Runes during repayment compared to the Runes burned during borrowing. However, when Rune’s price rises by 30%, there will be no additional Minting of Runes during repayment, keeping the protocol in a deflationary state. Conversely, if the price of BTC rises significantly more than Rune, the protocol will Mint more Runes, leading to a collapse in the mechanism. Once the Minted quantity approaches the upper limit, the protocol will increase the Collateral ratio to a maximum of 500%, forcing users to refrain from borrowing more USDT. Assuming the 500 million Rune upper limit is reached, the protocol will halt all lending and repayment activities until the BTC price falls, and no more Runes need to be minted.

It is easy to see that when the protocol constantly borrows, it benefits the protocol itself (Rune deflation). However, it cannot withstand large-scale repayments (Rune inflation). Therefore, the Thorchain model is inherently limited and unlikely to achieve significant scale, potentially leading to a fate similar to the tragedy of Luna 2.0. Additionally, as the loan quantity is controlled through the collateral ratio, the platform’s CR ranges from 200% to 500%, significantly higher than traditional lending platforms like AAVE with ratios of 120-150%. This low capital utilization is not conducive to meeting the lending demands of mature markets.

1.2 Transferring Liquidation Risk to Lenders

Cruise.Fi is a collateralized lending platform with stETH as the collateral. By outsourcing the liquidation risk to other lenders who are willing to bear it, as long as there are users willing to take over, theoretically, there won’t be liquidations. For borrowers, this reduces the risk of liquidation, providing more room to handle positions. For users willing to take over positions, there is an opportunity to earn additional income (basic lending returns + extra ETH rewards).

Borrowing Process: When a user collateralized stETH, USDx is generated, which the user can then exchange for USDC in the Curve pool. The interest generated from stETH is eventually distributed to lenders. There are two methods to maintain the price of USDx:

When the USDx price is too high, a portion of the stETH returns will be given to the borrower to subsidize their high borrowing costs.

When the USDx price is too low, a portion of the stETH will be converted to cover the borrowing cost, subsidizing the lenders.

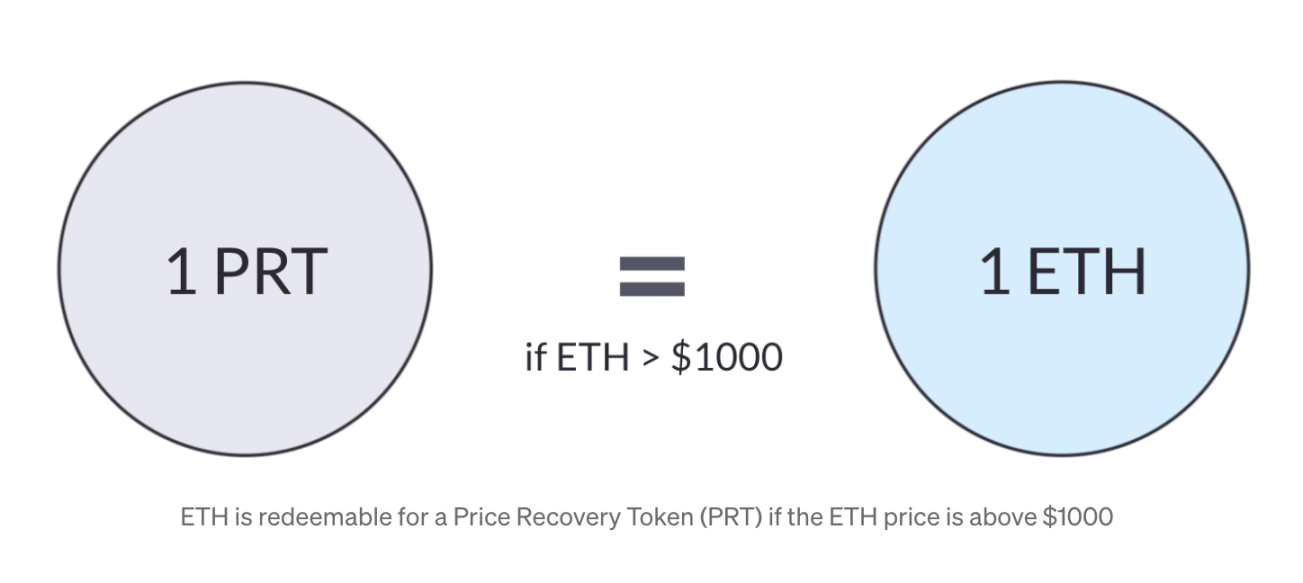

In achieving non-liquidation for the project, let’s consider a scenario where the collateralized ETH is valued at \(1500, and the liquidation price is \)1000. When liquidation occurs, the platform first locks the collateral (stETH), and then directs the stETH staking rewards to the borrower. By utilizing the stETH staking rewards, a portion of the original position is retained. Positions exceeding the stETH reward portion are temporarily suspended. However, a drawback of this approach is that as the ETH collateralization ratio increases, it impacts the stETH rewards, resulting in a reduction of the retainable position.

Regarding the originally liquidated position, the platform generates Price Recovery Tokens (PRT). When ETH returns above the liquidation line, lenders can exchange these PRTs 1:1 for ETH. This adds an extra layer of excess ETH returns compared to traditional lending platforms, which typically only offer lending interest. Of course, if lenders do not believe ETH will rise above $1000, they can sell PRTs on the secondary market. While the project is still in its early stages, and many data and secondary market details are yet to be perfected, the author boldly predicts that if lenders sell PRTs on the secondary market, borrowers could repurchase their positions at a lower price (compared to replenishing collateral) and also benefit from future excess ETH returns.

However, the project also has a downside. It can only thrive in a bull market, and even in the case of a significant market downturn, there needs to be a belief among ETH holders to provide liquidity. If a bear market arrives and market sentiment reaches its freezing point, liquidity will dry up, posing a significant threat to the platform. Moreover, there might not be many users willing to act as lenders on the platform, as the protocol inherently shifts all the risks onto lenders.

1.3 Interest Covering Borrowing Rates

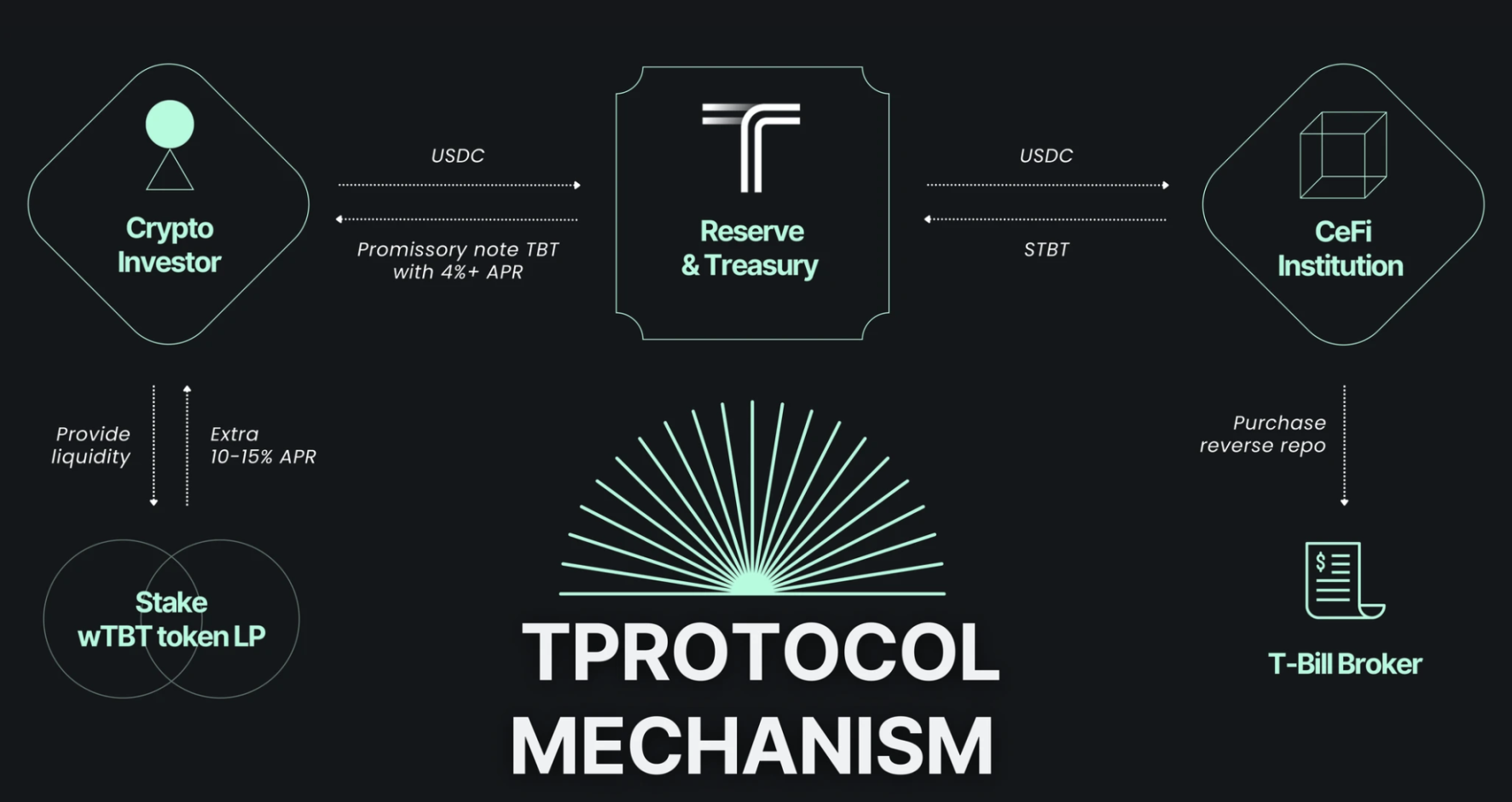

The wave of interest rate hikes by the Federal Reserve has also led to a batch of RWA “non-liquidation” protocols. One of the most noteworthy and largest in scale is T Protocol, where STBT represents MatrixDock’s tokenized U.S. bonds, pegged 1:1 to U.S. bond yields. TBT, on the other hand, is the wrapped version of STBT issued by T Protocol. It uses a rebase mechanism to distribute U.S. bond yields to platform users. Users only need to deposit USDC to mint TBT and enjoy U.S. bond yields.

The key highlight is that the interest charged by the platform is always less than the U.S. bond yield. Assuming the U.S. bond yield is 5%, the platform charges about 4.5% in interest to be distributed to lenders, with the remaining 0.5% acting as a fee. In this way, MatrixDock can collateralize U.S. bond-wrapped tokens for interest-free borrowing. However, how does the platform address the issue of non-liquidation? Essentially, the platform employs the logic of collateralizing U.S. dollars to borrow U.S. dollars, unaffected by assets like BTC. Currently, the Loan-to-Value ratio (LTV) is 100%. When MatrixDock collateralizes one million dollars’ worth of U.S. bonds, it can borrow one million dollars in stablecoins. When a user wants to retrieve their stablecoins, MatrixDock liquidates the U.S. bonds it owns, paying the equivalent to the user. Larger users may need to wait for three working days for settlement.

However, there are risks. Once MatrixDock receives the loan, if it engages in high-risk investments or similar activities, there is a risk of being unable to redeem U.S. bonds. All trust relies on the platform and the U.S. bond institution, creating regulatory blind spots and opacity. Consequently, the process of T Protocol seeking collaboration with other U.S. bond institutions is exceptionally slow, and there are limitations to its potential. Additionally, with future easing of macroeconomic monetary policies, U.S. bond yields are likely to decline. When interest diminishes, users may no longer find it necessary to deposit funds on the platform, turning to other lending platforms.

2.Summary and Reflection

The author believes that, up to this point, most non-liquidation protocols are essentially “pseudo non-liquidation.” They shift risks from borrowers to other entities, such as Thorchain shifting risks to the protocol itself and Rune holders, Cruise.Fi transferring risks to lenders, and T Protocol shifting risks to opaque regulation. It is evident that these protocols face a common challenge: achieving economies of scale is difficult because lending itself is inherently unfair to one party. The short-term “high” returns resulting from this unfairness are also hard to sustain and are perceived as unstable by users.

Ultimately, users tend to prefer traditional lending platforms like AAVE, embracing fairness despite the risk of liquidation. The essence of liquidation is insolvency, and since all assets experience fluctuations, there is fundamentally no risk-free investment in the world. Traditional finance, from its inception to the present day, has not “designed” a perfect risk-free investment. The high volatility in the cryptocurrency world only exacerbates this reality. Non-liquidation protocols may reappear in the public eye in a relatively “stable” manner, but ultimately, someone will bear the painful cost.

【免责声明】市场有风险,投资需谨慎。本文不构成投资建议,用户应考虑本文中的任何意见、观点或结论是否符合其特定状况。据此投资,责任自负。