The topic of Just-in-time liquidity was a hot topic at DuneCon — as the concept is said to enhance liquidity for liquidity providers (LP) and improve a DEX’s competitiveness. Our portfolio company, iZUMi Finance, has recently launched a JIT liquidity dashboard on Dune analytics, which will be elaborated in our analysis below.

What is JIT Liquidity?

Just-in-time liquidity refers to the LP strategy whereby the LP performs the following steps:

LP observes a pending sizable swap transaction in the public mempool,

Adds liquidity to the Uniswap pool and the swap will go through immediately before the swap happens. It is usually concentrated in one tick that the swap will be in-range.

The swap will execute and LP receives a fee in return for providing liquidity to the swap

LP removes the liquidity and fees accrued immediately after the swap transaction

LPs earn the difference between transactions fees associated with the hedge. This is because when LP perform JIT liquidity, they will complete a hedging transaction in a different liquidity venue to offset their inventory risk.

The State of JIT Liquidity

JIT transactions are very rare — Only ~1% liquidity added in Uniswap V3 WETH/USDC 0.05% pool is JIT liquidity. They’re put in 1% price range, and will be removed within 1 block after drawing fee from a large trade, by using MEV bots.

iZUMi Research JIT Liquidity Dashboard

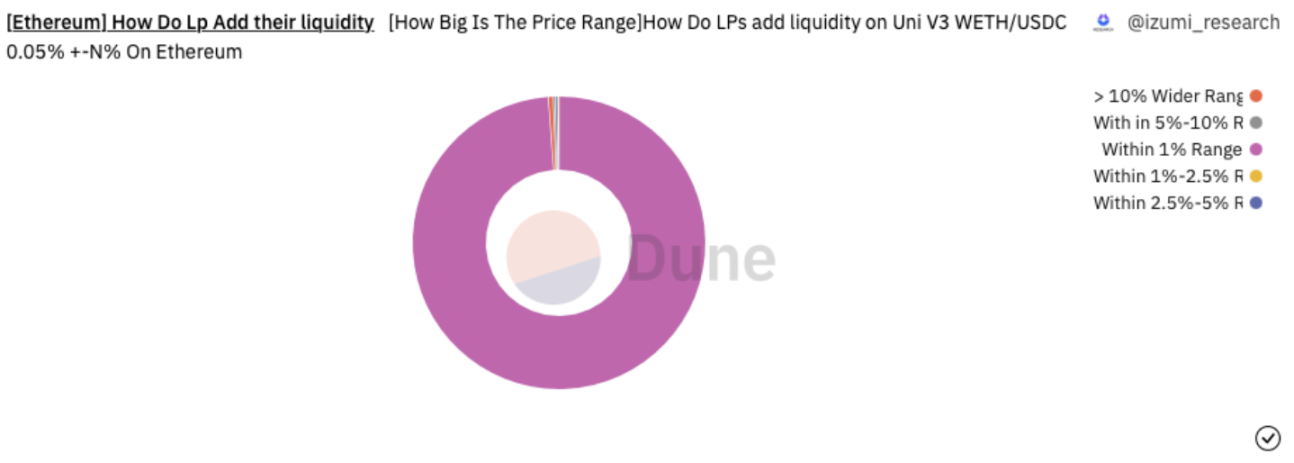

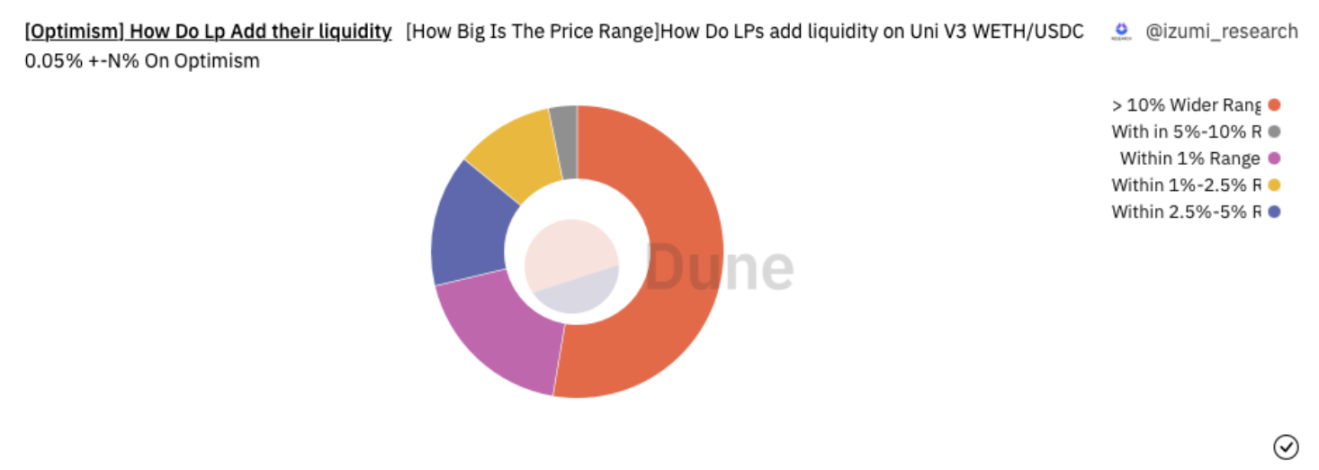

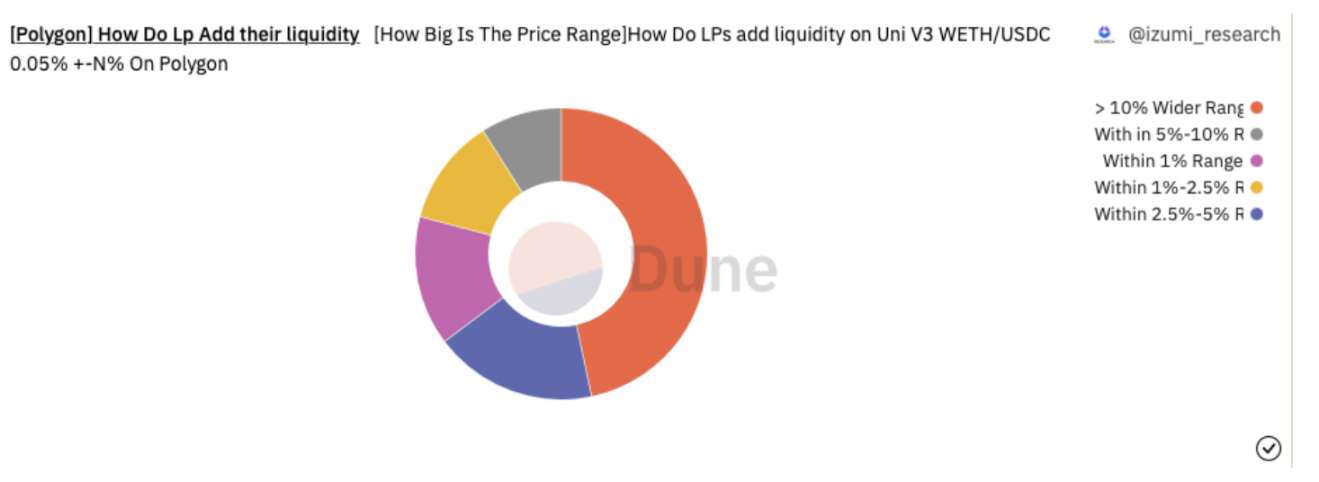

The research team of our portfolio company iZUMi Finance has published a comprehensive dashboard in Dune ‘The state of JIT and Liquidity Added’. The dashboard examines the price range added on Uni V3 WETH/USDC 0.05% pool, across Ethereum, Optimism and Polygon.

The key findings is that the price range for Ethereum, with JIT transactions, is mostly within 1%. In contrast, Optimism and Polygon do not have JIT liquidity transactions, and the majority price range is more than 10%.

For details, check out iZUMi Research’s Dune Dashboard here!

Conclusion

JIT liquidity provision enhances liquidity for traders that make Uniswap more competitive. However, if JIT liquidity function is disabled, the liquidity will be directed to other order tools in aggregators (E.g. request for quote), which in turn lowers Uniswap’s competitiveness.

Resources

Just-in-time Liquidity on the Uniswap Protocol

About Everest Ventures Group

Everest Ventures Group (“EVG”) is a Web 3 focused venture studio with presence across five continents. Since 2018, it has incubated multiple technology infrastructures such as Kikitrade, Aspen Digital, Vibra Africa, LiveArtX, Cassava and BlockTempo to drive the mass adoption of digital assets. In addition, EVG is an early investor and advisor to 40+ blockchain projects globally, including renowned startups like Dapper Labs, Animoca Brands, Immutable, The Sandbox, Yuga Labs, Kraken, Lukka, Upbit and more.

About iZUMi

iZUMi Finance is a multi-chain DeFi protocol providing One-Stop Liquidity as a Service (LaaS). Its philosophy is that every token deserves a better on-chain liquidity in an efficient and lasting way. Deployed on Ethereum, BNB Chain, Polygon, and Arbitrum, iZUMi has provided liquidity services for BitDAO and 10+ protocols, and managed over $60M liquidity from reputable institutions and 8,000 individual LPs.

【免责声明】市场有风险,投资需谨慎。本文不构成投资建议,用户应考虑本文中的任何意见、观点或结论是否符合其特定状况。据此投资,责任自负。