From the history of crypto, the bear market is a usually good time to filter out malicious actors and allows us to research and spot long-term opportunities. In this article, we identify 5 trends that can be the potential catalysts for next bull run, namely:

ZK-rollup (StarkWare and zkSync)

Aptos

Cosmos Hub 2.0

Celestia

SocialFi

ZK-rollup

Rollups are a powerful new layer-2 scaling paradigm, and are expected to be a cornerstone of Ethereum scaling in the short and medium-term future. Compared to optimistic rollup, ZK-rollup enables faster transaction times as it eliminates waiting periods for transaction processing.

StarkWare

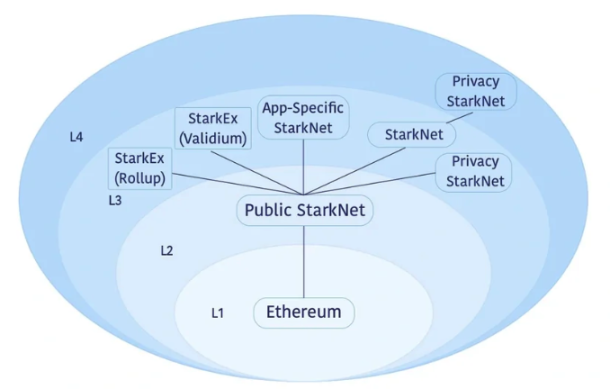

Starkware is a blockchain technology company focusing on developing zk-Rollup technology and building products to solve the scalability challenges of the Ethereum network. The company has launched two products: StarkEX (L2 scalability engine) and StarkNet (L2 scalability network).

We are bullish on Starkware in capitalising the growing demand in ZK-rollup solutions:

Initial success of StarkEx: StarkEx leverages STARK technology to power scalable, self-custodial trading and payment transactions for applications such as DeFi and gaming. The success of StarkEx is based on its Cairo language design, a Turing-complete language that is able to validate any business logic.

Combining STARK and Cairo enable StarkEx to support multiple ETH token standards (ERC-20, ERC-721, ERC-1155) and tokens on other EVM-compatible blockchains. StarkEx is in live operation since June 2020, and supports major applications such as dYdX, Sorare, Immutable and rhino.fi. dYdX currently ranks 3rd in terms of total value locked across Layer-2 applications.

Cairo is the native smart contract language of StarkNet, a permissionless decentralised ZK-rollup on Ethereum. StarkNet is currently at its Alpha version and supports Solidity to Cairo compiler. Similar to zkSync, StarkNet uses Argent as wallet and Stargate as layer-2 bridges. However, the ecosystem is still at a very early stage.

**All-star team in STARK technology **: Co-founder Eli Ben-Sasson was the founding scientist of ZCash, and co-founded zero-knowledge proof systems SK-SNARKs and ZK-STARKs. Another co-founder Alessandro Chiesa was the co-founder of ZK-SNARKs and ZCash. Starkware’s team has a total of 80.

STARK-proof system can minimise data storage like one is zipping a file on the computer, enhancing scalability potential and outperforming peers like ZKSync and Optimism.

- Decent fundraising track record: Starkware started its fundraising journey since 2018, and raised a total of 6 rounds. In May, Starkware raised \(100m at a valuation of \)8B, and saw participation from Coatue and Tiger Global.

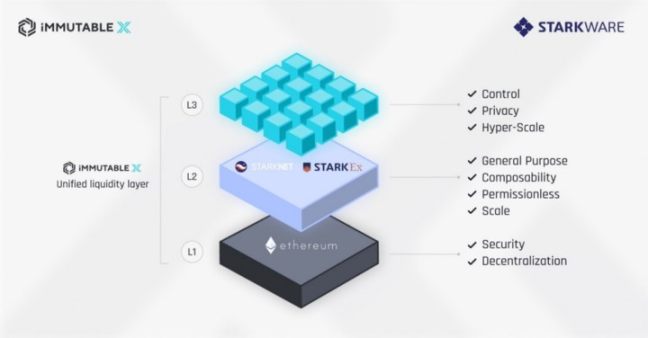

- Partnership with Immutable: StarkWare partnered with Immutable in May, allowing massive scaling of trustless non-custodial training and NFT minting through StarkEx. On the other hand, with StarkNet, developers will be able to deploy custom, composable smart contracts, making it easy for projects to migrate L1 smart-contract based games to Immutable instantly.

zkSync

zkSync is built on ZK rollup architecture and is a scaling and privacy engine for Ethereum. The current functionality includes low gas transfers of ETH and ERC20 tokens, atomic swaps, limite orders and native L2 NFT support.

zkSync 2.0 was introduced in February 2022, the first EVM-compatible ZK rollup on Ethereum’s testnet. We believe it provides a massive boost in ZK Rollup’s short term adoption:

EVM Compatibility: This enables easy porting of DAPPs to zkSync, as well as support Solidity language for smart contract developers. This also means zkSync is Ethereum Ethos compatible — to represent the values of the ecosystem with a decentralised model.

Strong ecosystem support: There are hundreds of applications built on zkSync, mostly on DeFi and wallet. However, only a few of them is currently live in operation, including Argent Vault, Increment and Banxa.

EVG House View

Zero knowledge proof (ZKP) algorithms eliminate many of the security weaknesses associated with password enabled authentication protocols. This is important in DeFi because ZKP enables secure and private data sharing for users. For developers, ZKP also helps them to create lightweight DAPPs that can run on common hardware devices like mobile phones, boosting crypto adoption in the long term.

In short term, we believe that zkSync has an edge over StarkNet in terms of adoption, due to EVM compatibility and thus onboards hundreds of DAPPs to launch on zkSync.

Over the long term, we believe that ZK-STARKs (E.g. StarkNet) has an edge over ZK-SNARKs (e.g. zkSync) in terms of scalability and quantum resistance. ZK-STARKs are more scalable in computational speed and size than ZK-SNARKs, with potential proving speed increase of 10x. In addition, Starkware’s founding team has a strong track record in deploying STARKs into various applications.

In contrast to zkSync, Starknet does not natively support EVM. However, we don’t think it’s a huge issue as smart contract developers can opt to convert their Solidity code to Cairo using Warp.

While Starknet’s ecosystem is less mature than the Optimistic rollup protocols, we are optimistic for Starknet to stand out in the long term with growing community and DAPPs ecosystem (E.g. ArgentX).

Following StarkWare partnership, Immutable X will support multiple L2/L3 zk-rollups, meaning that the largest games on Ethereum can be built without constraints and achieve true planet scale.

Aptos

Built by Aptos Labs, Aptos is a safe and scalable Layer-1 blockchain. Aptos brands itself as the inheritor of Diem’s legacy. Diem was a stablecoin built by Meta (formerly Facebook), and the project made its exit following the acquisition by Silvergate in February 2022.

Aptos can be the ‘game-changer’ among layer-1 blockchains with the following reasons:

Highly scalable: Parallel execution is one key feature to achieve high scalability of Aptos blockchain. Most Layer-1 blockchains use sequential execution. When there’s a new trade, the transaction is added to a single long ledger and updated via thousands of nodes. However, each transaction is added one at a time and it’s time-consuming to wait for all transactions to be verified.

Parallel execution runs multiple simultaneous chains in parallel, and allows more transactions to be processed at once. In Aptos’s testnet, it’s reported that the blockchain can handle 130,000 transactions per second, as opposed to 30 TPS of Ethereum.

Move Programming language: Developed by Diem developers, Move is a flexible programming language used to implement custom transactions and smart contracts. Move is designed for safe resource management and verifiable execution on a blockchain, which also facilitates secure execution and simple auditability.

Rapid ecosystem growth: In July, Aptos Labs raised $150m Series A funding led by FTX Ventures and Jump Crypto, including investments from a16z, Multicoin Capital and Circle Ventures among other crypto firms. There are over 100 projects built on Aptos blockchain, with use cases spanning across DeFi, NFT, Gaming and more.

Aptos Labs has announced the launch of Aptos mainnet on October 17. The blockchain currently handles 4 transactions per second (TPS), and is far from the expectation of 100k+ TPS. However, this is understandable given Aptos is still at its early days. The majority of transactions are merely validators communicating and writing metadata to the blockchain.

EVG House View

We believe Aptos has strong potential in delivering high scalability, compared to existing L1 blockchains. Parallel execution of Aptos is one key differentiator from sequential execution, however, the vision may only be achieved in the long term once Aptos has a more mature ecosystem.

Move language is a more developer-friendly language than the existing ones like Solidity, which offers early incentives to onboard DAPP developers. Aptos has an early-mover advantage than its counterparts SUI with its mainnet launch.

Cosmos Hub 2.0

Cosmos is the internet of blockchains — connecting thousands of applications via inter-blockchain communication. Recently, Cosmos Hub 2.0 whitepaper was announced during the Cosmosverse event, detailing the future strategic developments of Cosmos blockchain.

- Lambda upgrade: This is the upcoming major upgrade for Cosmos, which brings a few key features:

Liquid staking: This concept is similar to liquid staked ETH (\(stETH) in DeFi DAPPs like Aave, allowing users to use their staked collateral as a liquid token. For instance, users can trade or send staked \)ATOM across other Cosmos chains.The end result is enhancing user’s capital efficiency by unlocking additional capital, whilst the capital remains staked to maintain network security. Liquid staking also applies to other PoS assets on the Cosmos ecosystem.

Interchain security: This feature involves i) Provide chain (whose validators to provide network security) and ii) Consumer chain (the one secured by Provider chain). In exchange for providing security, the provider chain receives some of the consumer chain’s gas fees and staking rewards.Interchain security reduces barriers of entry for Consumer chain and enables potential applications such as rollup settlement, IBC routing, multiverse and chain name services.

Revamped tokenomics: $ATOM has a new monetary policy that involves a transitory and steady phase. For transitory phase, it begins with a significant increase in issuance, lasting for 36 months before reaching a steady issuance rate that lasts indefinitely. The initial issuance increase aims to bootstrap the new Cosmos Hub Treasury in expanding the ecosystem going forward.

NFT Module in future: While liquid staking will empower DeFi ecosystem in Cosmos, the roadmap also outlines its NFT module. The module offers collectible, custody, provenance and marketplaces, allowing simple management for NFT owners. In addition, NFT can be transferred across different Cosmos chains through IBC.

EVG House View

We believe the USDC Consumer Chain will be the most important update for driving the future of Cosmos Hub 2.0. Currently there’s a lack of native stablecoins on Cosmos, leading to limited DeFi activities and stablecoin liquidity. USDC will be the main currency on Cosmos and can be transacted to other chains such as Osmosis and Juno to bootstrap liquidity.

Another point to note is that USDC chain will be the only chain that settles deposits or withdrawals from centralised exchanges. This is important because previously there’s no aggregated liquidity pooled from centralised exchanges.

Liquid staking is an important feature that not only enhances Cosmos’s security, but also enables higher returns as users can used staked ATOM in other yield generating activities.

Celestia

Many DAPPs cannot run effectively on shared smart contract platforms, such as Ethereum, NEAR and Solana. While these DAPPs use Cosmos/Polkadot to create their own blockchains, it is a very time-consuming and expensive process.

This is where Celestia comes into play. Celestia is a pluggable consensus and data availability layer, to enable anyone to quickly deploy a decentralised blockchain without the overhead of bootstrapping a new consensus network.

Celestia belongs to the modern crypto ecosystem, allowing Dapps to run on app-specific chains that share consensus layers.

Pioneering modular architecture: There are 3 layers in the Celestia’s ecosystem. Celestia is the base layer that guarantees the availability of data and efficiently achieves consensus. On top of it is execution environments, which consists of different modules to reference existing data and execute transactions — examples include EVM, WASM and rollups.

DAPP layer will be on top of execution environments, and include modules such as DeFi, NFT marketplaces and games.

Cosmos Partnership: Celestia will play an important role as a shared security layer of Cosmos SDK Chains. Celestia is also working with the Interchain Foundation to bring optimistic rollup support to the Cosmos SDK, so that developers can build blockchains with the Cosmos SDK that use Celestia for consensus, instead of having to use Tendermint to deploy a new proof-of-stake network. This will turbocharge the inter-blockchain communication (IBC) protocol, as Celestia will provide a secure shared consensus layer that Cosmos zones can use and rely on, allowing zones to communicate with each other using IBC without zones needing to trust each other.

Strong VC support: Celestia has closed a $1.5m strategic seed fundraise in March, garnering investors such as Interchain Foundation, Binance Labs, KR1, Signature Ventures and more.

EVG House View

We are an investor of Celestia and are bullish on its pioneering modular architecture. Celestia envisions to solve a massive main point of DAPP deployment — developers can build their own blockchains without worrying to bootstrap a new consensus layer, leading to massive cost and resource savings.

We believe modular blockchain is a paradigm shift in blockchain designs, the partnership with Cosmos accelerates Celestia’s network effect.

Celestia’s modular design also paves the way for efficient resource pricing. As the state growth is priced separately from data consumption, this means a spike in GameFi activities on Celestia-built blockchains, won’t deteriorate experience of DeFi Degens trading on the same blockchain. Therefore, incidents like CryptoKitties’s network congestion on Ethereum is not going to happen in Celestia.

SocialFi

Decentralised ID

Decentralised identity is an emerging concept in Web 3 that allows people to generate, manage and control their personally identifiable information (PII) without a centralized third party. It is positioned for future mass adoption in Web 3, as user’s digital identity can combine with soulbound tokens as on-chain credentials.

One example in decentralised ID is Space ID, a universal name service network built on BNB Chain. User’s Space ID (SID) will connect wallet addresses across different blockchains, as well as off-chain information like legal names and social media handles. In future, DID will be used in the metaverse as one’s on-chain credentials, acting as membership pass to unlock various features in the metaverse.

Social Graph

A decentralised social graph network uses blockchain technology to map social relations among individuals. In contrast to traditional social graphs like Facebook’s, decentralised social graph returns data ownership back to users. Examples of blockchain-based social graph protocols include Lens Protocol and CyberConnect.

Lens Protocol is an open source social graph protocol first built on Polygon. Unlike centralised social graphs, Lens protocol does not fall victim to single point of failure as its open source social graph architecture is decentralised.

Introduced in early 2022, Lens Protocol is one of the most popular social graph protocol with the following features:

Team with proven Web 3.0 record : Lens Protocol is founded by Aave team members — who created the leading DeFi lending protocol with a TVL of $5.5B.

NFT Profiling: The NFT represents ownership for users to gain control of their own content and a wallet address can contain multiple profile NFTs. The profile NFTs contain the history of user’s writer profile, including past articles, comments, and other content.

Modular design: Lens protocol applies Collect and Reference module in user-generated content. Collection module allows content creators to earn income by letting users mint and purchase content as NFTs. Reference module keeps track of the references made to the published content.

EVG House View

We have seen growing demand towards SocialFi — for both users and content creators. Recently, YouTube premium subscribers in Argentina got a massive price hike (Family plan from 179 ARS to 699 ARS). However, content creators do not benefit anything from them and their payout is determined by YouTube’s pre-set algorithms. As a result both parties are looking for alternatives for a fairer content ownership and revenue sharing approach.

Decentralised ID, combined with Soulbound token, is a core infrastructure paving for an interoperable future across metaverses and games. While we have seen numerous DID protocols looking to fundraise, we believe this segment is a ‘Winner-takes-all’ place and only a few players can stay for the long term.

Social graphs is the core infrastructure for users to retain data ownership in Web 3.0. However, we expect social graphs having a longer time to take off against DID, as there’s a lack of established social media in Web 3.0.

Conclusion

Bear market is the time to research and BUIDL, and we believe that new infrastructures will be the core to empower the next bull cycle run. Reach us at info@evg.co for investment opportunities and synergies!

About Everest Ventures Group

Everest Ventures Group (“EVG”) is a Web 3 focused venture studio with presence across five continents. Since 2018, it has incubated multiple technology infrastructures such as Kikitrade, Aspen Digital, Vibra Africa, LiveArtX, Cassava and BlockTempo to drive the mass adoption of digital assets. In addition, EVG is an early investor and advisor to 40+ blockchain projects globally, including renowned startups like Dapper Labs, Animoca Brands, Immutable, The Sandbox, Yuga Labs, Kraken, Lukka, Upbit and more.

【免责声明】市场有风险,投资需谨慎。本文不构成投资建议,用户应考虑本文中的任何意见、观点或结论是否符合其特定状况。据此投资,责任自负。