Hong Kong FinTech Week kicked off on Oct 31, attracting 20,000 professionals and over 3 million online viewers to learn more the evolving landscape of FinTech. In particular, the Hong Kong government outlined its ambitions for Hong Kong to become the international virtual asset hub.

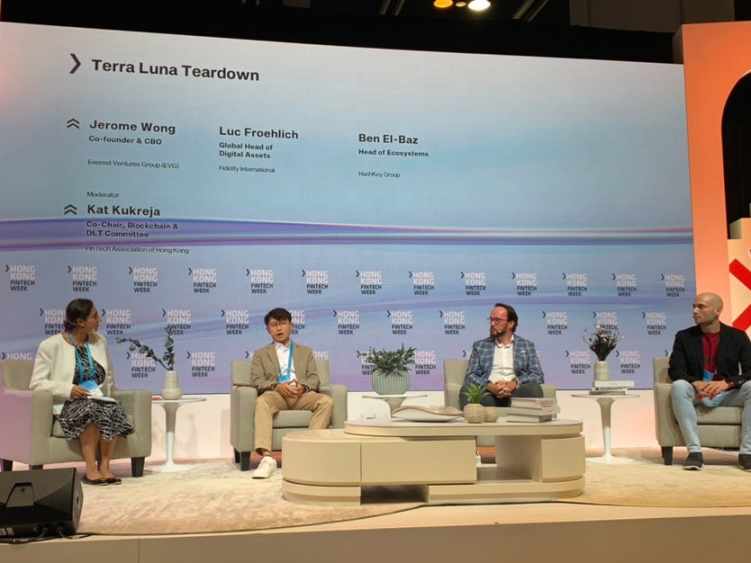

The Web 3 landscape, including DeFi and metaverse, has attracted tremendous attention from the attendees. In the Web 3 stage panel “Terra Luna Teardown’, our Co-founder and Chief Business Officer Jerome Wong shared his insights on the future of DeFi and algorithmic stablecoins with Ben El-Baz (Head of Ecosystems at Hashkey), Luc Froehlich (Global Head of Digital Assets Solutions, Fidelity International) and moderator Kat Kukreja (Co-Chair, Blockchain & DLT Committee at FinTech Association of Hong Kong).

Here are the key takeaways from Jerome:

- Terra LUNA aftermath: Negatives and Positives

Since the Terra LUNA incident, total value locked (TVL) in DeFi took a severe hit from 150B to 50B (66% drop)! Three Arrows Capital, who has significant exposure on LUNA and ultimately declared insolvent in July. Such domino effect also caused troubles in other CeFi platforms like Celsius, BlockFi, Voyager Digital, Genesis Trading and more — some filed bankruptcy or halted withdrawals for their customers.

Retail investors are not immune from the Terra breakout, losing their deposits on Anchor Protocol that promised a 20% yield.This is largely due to the lack of understanding in the source of yield.

In essence, if one does not know where the yield source is generated, users themselves are the yield source!

On the positives, the Terra LUNA collapse exposed the bad actors in Web 3 — unaccountable managers taking over-leveraged positions. Regulators also stepped up and prioritised to regulate algorithmic stablecoins (and DeFi in general), prioritising investor protection that is beneficial to DeFi in the long term.

2. Future for algo stablecoin operators

The Terra collapse stemmed from its algo stablecoin design — the stablecoin is undercollateralised and backed by volatile assets like LUNA. The design has been proven unsustainable, and U.S. proposed House Stablecoin bill is set to place a two-year ban on ‘endogenously collateralized stablecoins’. This applies to stablecoins which is backed by tokens in the internal ecosystem (E.g. LUNA for UST, NEAR for USDN). It’s important to note that DAI doesn’t fall into the category, as it uses exogenous collateral like USDT and ETH.

What’s more, Algo stablecoins issuer could face new competitions from traditional banks. The House Stablecoin bill would allow banks and non-banks to issue stablecoins. Bank issuers would seek approval from their typical federal regulators, such as the (OCC) Office of the Comptroller of the Currency.

Following regulatory scrutiny, some algo stablecoin operators started to diversify their businesses. For instance, Frax Finance launched a Dual token model for liquid Ether staking.

3. Bullish on DeFi’s future

We share similar sentiments with other panelists and are bullish on DeFi for the long term. Having a solid infrastructure and fulfilling DeFi’s initial primitive are essential for mass adoption.

First and foremost, smart contract wallets like MetaMask are the entry point for DeFi. While MetaMask already has 30m+ monthly active users, users need to store seed phrases to safeguard their account. A more optimal user experience would be using smart contract wallets as seamless as electronic wallets. For instance, having social recovery features that allow email/mobile login-in, and the ability to use the wallet without memorising seed phrases would be a massive innovation for smart contract wallets. Argent is one example that working toward a more seamless user experience.

The initial primitive of DeFi — financial inclusion — is crucial to empower mass adoption in future. We’ve seen limitations in international remittance, especially in unbanked regions like Africa, and people need to pay high remittance costs like 10%. Africa presents the blue ocean opportunity with 1.2B population in which more than 500m are unbanked. Onboarding these population to crypto can be challenging, and it’s important to offer a simple, one-for-all application for Africans to use/spend crypto. One example is our incubatee Cassava Network, the infrastructure allowing developers integrating their DAPPs, such as wallet, DeFi, GameFi, SocialFi and much more.

We believe the future of DeFi will be interoperable and flourish on multiple blockchains. We are bullish on scalable blockchain infrastructure such as ETH 2.0, StarkNet and zkSync v2, bringing lower costs for asset transfers. In addition, cross-chain bridges will play a more important role to DeFi, facilitating capital flows across different blockchains.

About Everest Ventures Group

Everest Ventures Group (“EVG”) is a Web 3 focused venture studio with presence across five continents. Since 2018, it has incubated multiple technology infrastructures such as Kikitrade, Aspen Digital, Vibra Africa, LiveArtX, Cassava and BlockTempo to drive the mass adoption of digital assets. In addition, EVG is an early investor and advisor to 40+ blockchain projects globally, including renowned startups like Dapper Labs, Animoca Brands, Immutable, The Sandbox, Yuga Labs, Celestia, Kraken, Lukka, Upbit and more.

【免责声明】市场有风险,投资需谨慎。本文不构成投资建议,用户应考虑本文中的任何意见、观点或结论是否符合其特定状况。据此投资,责任自负。