by Bittracy

At the end of 2021, GameFi has encountered obvious development bottlenecks, problems such as low game quality, lack of entertainment experience and homogeneity are getting more serious. The consensus of some investors is that the market needs GameFi with more entertainment attributes so that the game ecosystem with game value instead of revenue value can achieve ecological sustainability. Therefore, 3A game has become a potential direction. At this point, StepN popped out, showing the true value of “Move to Earn” to investors who haven’t see it until 2022.

There are already many stories about StepN and “Move to Earn” in the market, so I won’t repeat them here. The article is dedicated to discuss what has not been paid attention to — StepN’s past and possible future: what have been done before its explosion in 2022? What are the future possibilities of StepN? Will “X to Earn” be the direction of the market? The article will mainly answer the following questions through two parts:

- What efforts have been done before StepN’s explosion in 2022?

- After gaining widespread market attention, what is the main line of change in StepN?

- What is the reason for frequent parameter adjustment of StepN?

- Will “X to Earn” become the direction of the succession market?

What efforts have been done before StepN’s explosion in 2022?

1. Business model innovation, reject the Red Sea market of GameFi and turn to “Move to Earn”: Yawn, founder of StepN comes from Australia. As a continuous entrepreneur, Yawn began to invest in the primary market and mining after knowing Bitcoin in 2017. In this circle of bull market, he and Jerry Huang built a team wanted to make a difference in blockchain. StepN was launched in August 2021 as a GameFi project at the beginning. However, in the process of development, the team found serious homogeneity of GameFi, and it is difficult to make new ideas on the original model. At that time, there were more than 1,000 GameFi projects on the market, however none of them is about “Move to Earn”. Therefore, they developed a new business model of “Move to Earn”. Compared with DeFi, GameFi has an important advantage in reducing the user threshold.

Move to Earn” further reduces the user’s learning cost as every person runs. For StepN, the cost of user education is reduced while the audience is wider. In October 2021, StepN won the 4th place in Solana Venture’s 4th Hackathon Game Project. After the beta version was launched in November, the project has attracted over 1,000 players from more than 40 countries with a 70% user retention rate. The “Move to Earn” business model has been recognized by the market.

2. Emphasis on user quality and stable community expansion: StepN takes Japan and Europe as the focus of marketing operation, where users have fitness needs and habits. Endogenous user growth and healthy community structure are very important for the early development of the project. StepN considers guilds a heavy burden to the game, so they did not choose to cooperate with guilds to increase player numbers. As mentioned in our previous report, guilds play a very important role in GameFi and are the main source of liquidity in the early stage of a game. However, “Move to Earn” happens in running scenarios, and there is no need for NPCs “running with you”,so as for guild participation. Up to now, StepN is still not bound to any guild. In fact, it has been fighting against the “digging and selling” behavior of game guilds.

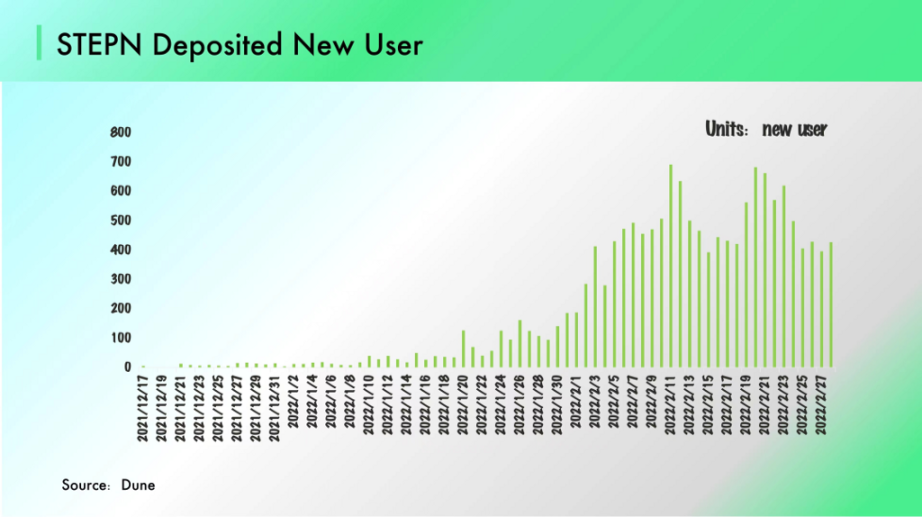

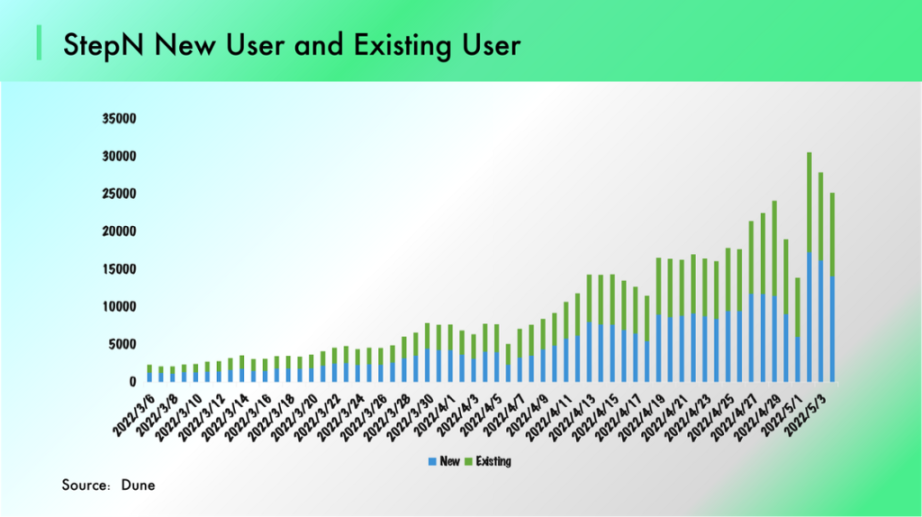

Referring to Dune data, we selected the data of new StepN users from last December to mid March. The new users of StepN did not show exponential growth before March (StepN gets listed on Binance on March 2), but maintained a steady upward trend. In the whole February, the net number of new addresses per day was 400+, an increase of 800% compared with the 50+ new daily addresses in January. Although there are various problems in StepN’s initial stage, the user retention rate has been maintained at a high level. Since players get NFT through community quiz activities, there was no pay back pressure, and even if the process of constant optimization would damage a certain revenue, players who get free sneakers didn’t care too much either.

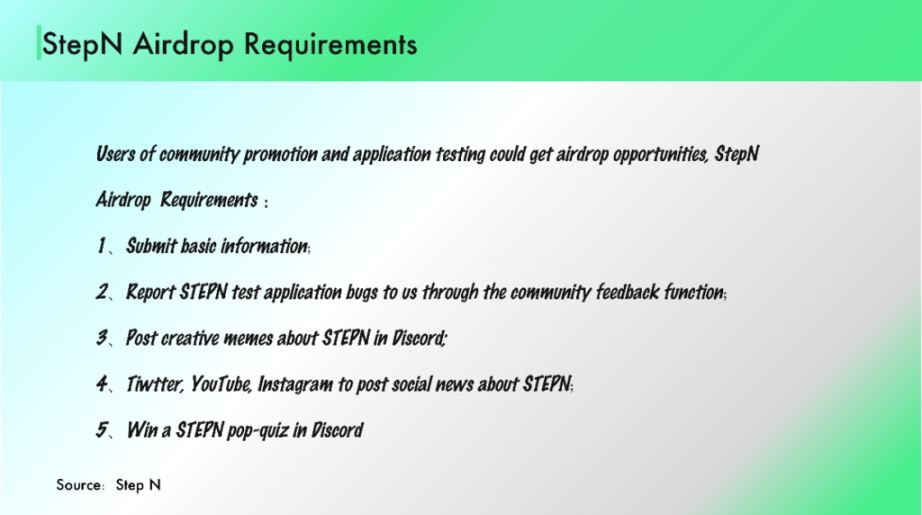

3. Long-term Value captured by the development team: For the project party, the income brought by selling NFT is very considerable, while StepN chose to airdrop NFT to the initial users for free. The way to get the airdrop is very simple, promote and try it out. In this way, StepN strengthens the bond between the community and the initial users, which brings about 10k quality participants for StepN. It is worth noting that StepN is not a niche project. On the contrary, at the very beginning, StepN’s investment team included many top institutions such as Solana Venture and Folius Ventures. Selling NFT will bring a lot of benefits to the project, however StepN gives it away for free. Such losses are also obvious, the project will not get obvious income before launching the game, they took the long view.

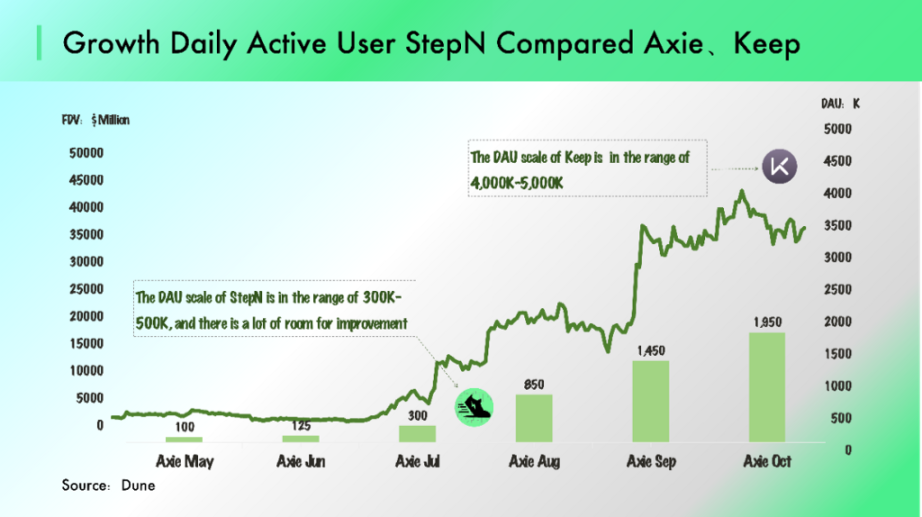

Entrepreneurs with long-term vision, correct blue ocean track, appropriate operation model and stable high-quality users, these attributes were not possessed by most GameFi projects at that time. Turning back to February, I shall applaud the institutions that fund StepN, this is a very good innovation and it’s even incredible that a “Move to Earn” GameFi without a guild would be as successful as it is. At present, the DAU of StepN is about 50W, which left room of three times for improvement compared to Axie Infinity’s highest million DAU.

Opinons on StepN’s future changes

Being the most popular project in the first quarter of 2022, the specific mechanism of StepN has been studied by the market. I myself has recently received a lot of Decks of StepN alternatives. Can StepN remain competitive after a large number of imitations? What potential does StepN have in the future? I’d like to draw the conclusion first.

- StepN’s economic stability and community expansion are the main lines of ecological development.

- “Move to Earn” does not have a strong competitive barrier. Running is compatible and provides good opportunities for competitors.

- Social attributes are key to StepN in raising valuation.

1. Tokenomics and community expansion are the main lines that determine StepN’s future changes:

1.a Tokenomics is the key to maintaining balance: users do not need a running application, but a “Move to Earn” model. Keeping the currency value stable is an important prerequisite for the development of the protocol. We regard StepN as an economic system, while NFT assets (sneakers) bring capital inflow to the economic system, and the output of GST and GMT represents the outflow of economic benefits.

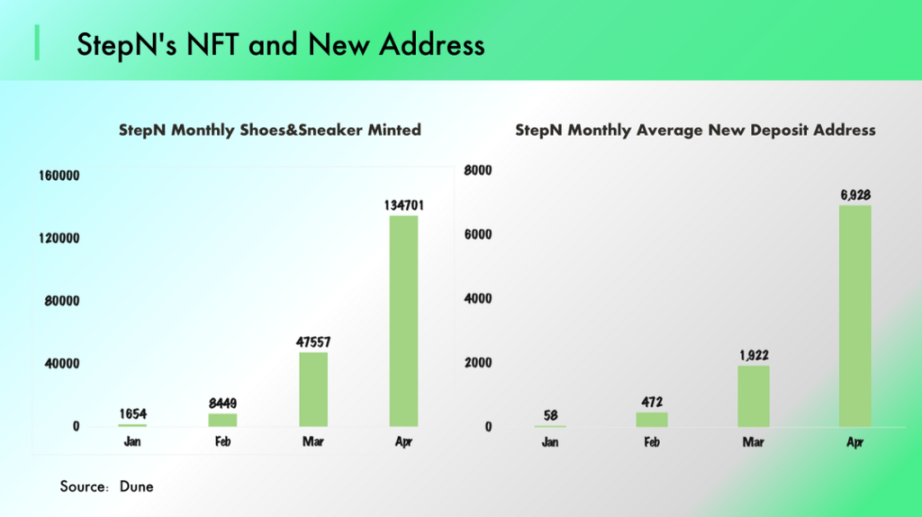

From the inflow side: the number of NFT minting and new users increased in the same proportion: the average daily new addresses of StepN was 1922 in March and 6927 in April, an increase of 360%; while the number of NFT sneakers increased by 283%. The growth rate of new users is in the same range as that of NFT sneakers. User growth is strong and NFT supply is limited. From the perspective of capital inflow, StepN’s Ponzi is in a very healthy stage. If this trend can continue, the ecosystem will remain quite resilient.

From the outflow side: StepN reduces the supply of GST by setting reward and energy cap, so as to control excessive output. At the same time, the project team also adjusted the implied GST consumption by adjusting parameters ( consumption for sneakers minting, Twins Event, etc.). They want users to spend the tokens they earned in the economic system, thereby reducing the outflow of funds.

At present, there are two important trading pairs in StepN, GST / USDC and GST / SOL. As the output of GST by “Move to Earn” is relatively stable, the exchange rate of the former determines the user’s sports income. And since the price of sneakers/gems is calculated in SOL, and the cost of minting and upgrading gems is mainly priced in GST, the exchange rate of the latter determines the raw material cost and return ratio of interest-earning assets (sneakers/gems).

0xBigPineapple

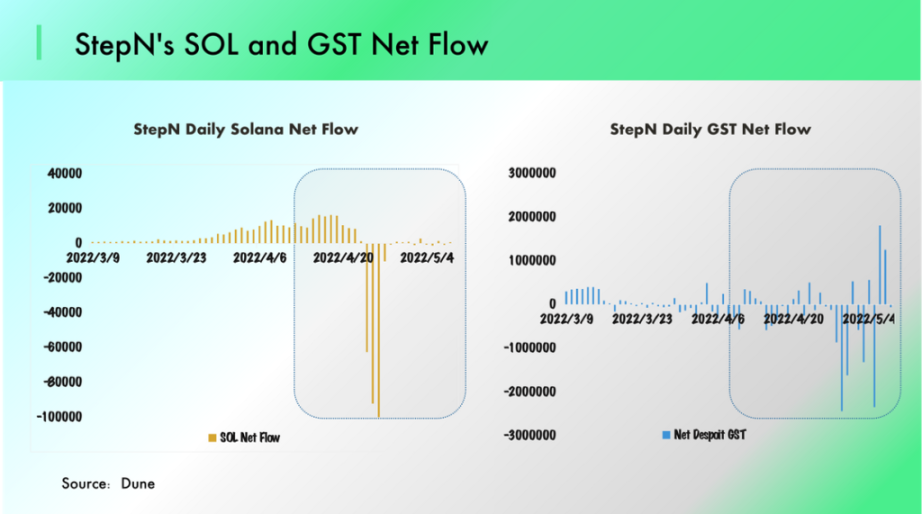

Observing the changes in the net inflows of GST and SOL from the capital side, after March, the Ponzi model has a tendency to weaken. And this tendency became more obvious in April. GST continued to flow out, and the influx of speculative users increased the pressure of fund withdrawal on the economic system. We see that recently the team is frequently adjusting the consumption mechanism to control the real output of GST, so as to guide the capital flow within the system. From an economic point of view, sneakers are still a game asset with unlimited interest-bearing capacity, causing excessive inflation in the economic system, and more importantly this problem cannot be simply solved by adjusting the output ratio. Therefore, in the long run, StepN will certainly modify the token model, otherwise, once the inflow of funds is suspended, the ecological stability will be difficult to maintain.

1.b Community expansion: Multi-chain deployment and rental system may not be a good choice: After Binance invested in StepN at a valuation of one billion US dollars, it is logical for StepN to be deployed on BSC. Over 30 million people participated in the sneaker NFT mystery box sales. Due to the irrational hype of some crazy speculators in the BSC ecosystem, the price of sneakers of the same quality on BSC chain is several times higher than that on Solana. There is no arbitrage space in the token model of BSC and SOL ( no cross-chain for NFT and token ), thus the price of sneakers and GST are different on these two blockchains. For example, the pay-back period is less than 10 days if users use sneakers on BSC to mint new sneakers and then sell them.In contrast, the pay-back period of users running on SOL is around 30 days, which results in a stronger speculative intention on BSC.

I’d like to remind everyone that even if there is no multi-chain deployment, StepN is just a relatively healthy Ponzi model: the APY of users running on SOL is as high as 600%-1200%, which is unsustainable itself. For such a capital game, “building community + expanding ecosystem” is the only way to continue product life, same for Luna and Axie. If StepN wants to get out of such a dilemma, it needs to explore the second curve of growth. If the community expansion brings more speculative players, the help may not be so positive.

The launch of the rental system may increase the burden on the ecosystem: StepN still has no rental system. According to the data of Magic Eden trading platform, the current floor price of StepN sneaker is about 13 SOL, which is around 1248 US dollars, causing a relatively high threshold for potential users to participate in. The rental system can allow players to participate at a lower cost, reduce the participation threshold and promote community expansion. At the same time, it is also a double-edged sword — the flow it brings to the ecosystem is more income oriented. The reason is simple: users participating in the game in rental mode need to pay for a fixed cost, so the return is necessary for the these users. The rental system redistributes the investment income among different types of users: NFT holders get the rental income, and borrowers get running income, each party is taking advantages from the ecosystem. In short, for the protocol, the rental system is to obtain the growth of users and the expansion of the community with economic benefits. Dune data show that the new users of StepN are still expanding steadily, and the early launch of the rental system is more than worth the loss for StepN.

2. So far, StepN does not have a strong competitive barrier: In both decentralized and traditional markets, once a company’s business model is successful, developers will rush in. Looking back on the past two years, projects such as Axie, OHM, and AAVE have been imitated by their successors. In the past two months, investment institutions have been actively seeking for investment opportunities from “Move to Earn”. For now, I don’t think StepN has a clear competitive barrier yet. Compared with the leading projects of the DeFi track, for example, the competitive barrier built by Curve’s aggregated liquidity and ecological collaboration is much stronger than that of StepN, because in the “Move to Earn” model, users can be compatible with different protocols at the same time.

For example, if Alice deposits her funds in AAVE, she can no longer use the deposited funds to provide liquidity for other lending protocols. However she can download multiple “Move to Earn” Dapps on her mobile phone to run and earn money at the same time, and such user behavior will not be prevented by anti-cheating mechanism. Most of the StepN users I spoke to were open to the “Move to Earn” project. And many of the StepN alternatives said they would target StepN participants first when promoting to the community because they were already trained. This means that if StepN is not able to build a sense of identity, it is just a user training machine. Even if it is difficult for this alternatives to surpass StepN in terms of scale and position, they will divert StepN users, thus accelerating the collapse of the economic system.

3. Social attributes are key to StepN in raising valuation: Since the end of 2021, thesis such as DAO and Web3.0 have appeared in the market from time to time. Most of these protocols apply the Web2.0 business model in the tokenomics, which is not in line with the user habits in the decentralized world, thus it is certainly impossible to achieve ideal results. As of now, I still haven’t seen a social protocol with real potential in the market. Until the emergence of StepN, everyone suddenly discovered that decentralized social protocols do not necessarily focus on communication and content. There is certainly no consistent high revenue per se, but “Move to Earn” may be an effective way to aggregate Web3.0 users.

Compared with Axie, StepN, which has lower threshold and wider audience, StepN is the most promising decentralized protocol to realize social functions. If StepN can attract non-crypto users through a continuous and steady “Move to Earn” model and build good user stickiness, then it will become the retention platform of these non-crypto users. This is the key component to increasing StepN’s valuation. By the way, being a governance token, GMT occupies a very special position in the ecosystem, and I am looking forward to seeing the token effect of GMT being more in line with the economic system. Specifically, only in-depth users ( sneaker level 30 ) can stably produce GMT, and they are the most loyal and high-value users in the entire ecosystem. If StepN can make innovations on the token utility of GMT and empower more scenarios for “Move to Earn”, there will be a second wave of valuation improving.

To summarize

In essence, Axie and StepN are still the same in terms of the economic model behind them, but what they have changed is the way users participate. Compared with GameFi, StepN provides users with fitness value on the basis of income. Compared with Web2.0 fitness applications, “Move to Earn” enables users and developers to reach a new optimal solution, an innovative model that brought by Web 3.0. In the next article, I would like to share our views on Web 3.0 and “X to Earn”.

Reference

- https://mirror.xyz/0x3882A7c5b798c1DD17FC834caf6DB06908FC1F3a/xvAnYiQc-GMVbbyjclKONOG6NTZsVrTw7Jw2oRDoqmE

- https://earning.tw/stepn-ama/

- https://mirror.xyz/snapfingersdao.eth/x7qeuhMciWLN56cBOVvh6qdpzWckcOtFMjq0_7TnZM0

- https://mirror.xyz/0xCe6fde8581C110B429DfD6B5ECa2658284612cbc/57lXk_BO3o89g2a_cURTOKUnSOq8P6r2SSgyN3Lygt8

- https://mirror.xyz/0xCe6fde8581C110B429DfD6B5ECa2658284612cbc/57lXk_BO3o89g2a_cURTOKUnSOq8P6r2SSgyN3Lygt8

- https://www.listennotes.com/podcasts/51-with-mable/ep50-cn-yawn-jerry-jason-eyYZ0Vt2hlk/

- https://0xzx.com/2022030315122131420.html

- https://www.chaincatcher.com/article/2072187

- https://stepnofficial.medium.com/stepn-discord-nft-airdrop-campaign-q-a-61d2099144e6

【免责声明】市场有风险,投资需谨慎。本文不构成投资建议,用户应考虑本文中的任何意见、观点或结论是否符合其特定状况。据此投资,责任自负。